Pass ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam in First Attempt with DumpsBoss Practice Exam Dumps!

- Last Update Check: Mar 19, 2025

- Premium PDF & Test Engine Files with 186 Questions & Answers

- Certification Provider: ACFE

- Certification: Certified Fraud Examiner

- Exclusive Limited Sale Offer!

55-85% OFF

Hurry up! offer ends in 00 Days 00h 00m 00s

*Download FREE Test Engine Player

Introduction of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam!

The ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is a key component of the Certified Fraud Examiner (CFE) credential, focusing on the understanding of various financial transactions and fraud schemes. It helps professionals demonstrate their expertise in identifying, analyzing, and mitigating fraudulent activities in financial contexts.

What is the Duration of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The ACFE CFE-Financial-Transactions-and-Fraud-Schemes (Certified Fraud Examiner - Financial Transactions and Fraud Schemes) Exam is a specialized certification exam designed to test the knowledge and skills of professionals in detecting and preventing financial fraud schemes. It is part of the Certified Fraud Examiner (CFE) credential offered by the Association of Certified Fraud Examiners (ACFE).

What are the Number of Questions Asked in ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam typically consists of 100 questions.

What is the Passing Score for ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The passing score for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is 75% or higher.

What is the Competency Level required for ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The competency level required for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is generally intermediate to advanced, as it is designed for professionals with experience in fraud examination and financial transactions.

What is the Question Format of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

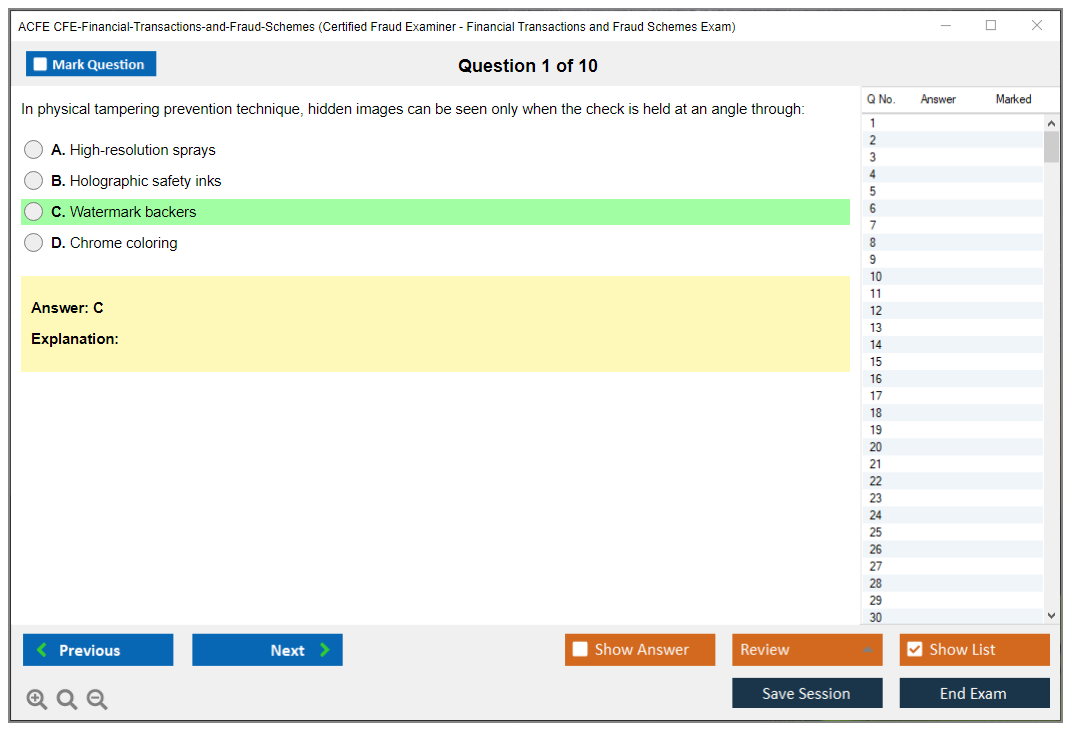

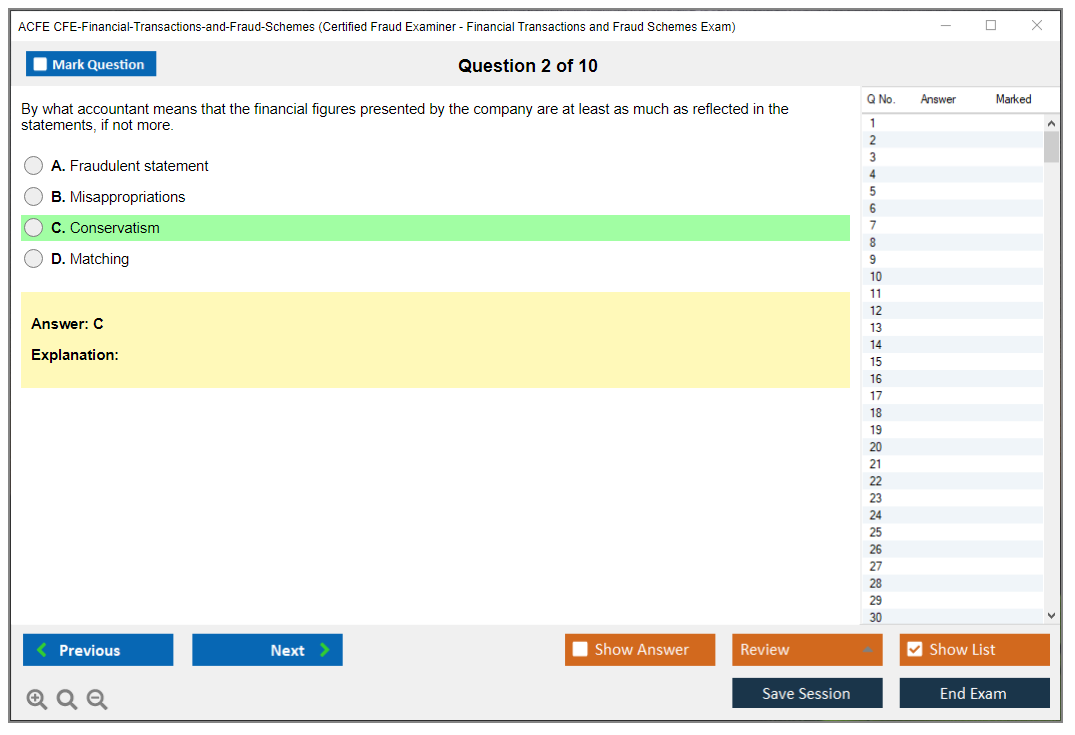

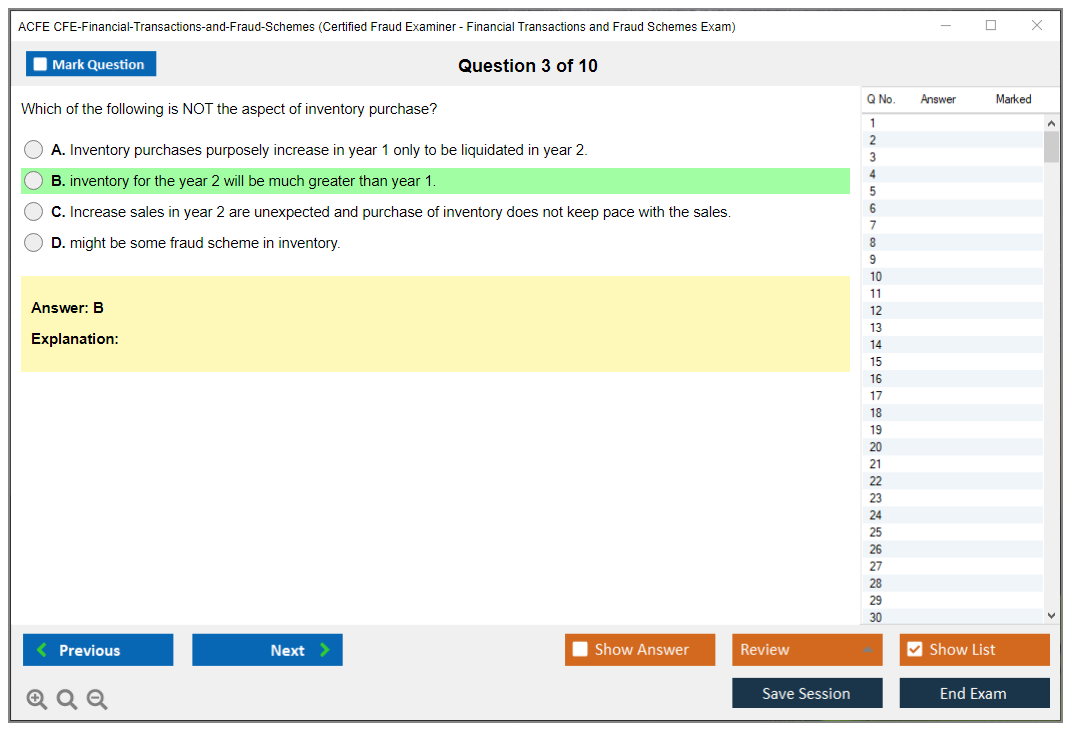

The question format of the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam includes multiple-choice questions.

How Can You Take ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

You can take the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam online through the ACFE's official website or at a designated testing center.

What Language ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is Offered?

The ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is offered in English.

What is the Cost of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The cost of the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam varies, but it is generally around $400 for ACFE members and $600 for non-members.

What is the Target Audience of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The target audience for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam includes fraud examiners, auditors, compliance officers, investigators, and other professionals involved in fraud detection and prevention.

What is the Average Salary of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Certified in the Market?

The average salary of a professional certified in ACFE CFE-Financial-Transactions-and-Fraud-Schemes varies widely depending on the region and role, but it generally ranges from $70,000 to $120,000 per year.

Who are the Testing Providers of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The testing providers for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam include the Association of Certified Fraud Examiners (ACFE) and its authorized testing partners.

What is the Recommended Experience for ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The recommended experience for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam includes a minimum of two years of professional experience in a field related to fraud examination or financial transactions.

What are the Prerequisites of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The prerequisites for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam include being an ACFE member and having a minimum of two years of professional experience in a relevant field.

What is the Expected Retirement Date of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

There is no specific retirement date for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam, but the ACFE periodically reviews and updates the exam content to ensure it remains current with industry standards.

What is the Difficulty Level of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The difficulty level of the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam is considered to be moderate to high, requiring a thorough understanding of financial transactions and fraud schemes, as well as practical experience in the field.

What is the Roadmap / Track of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

The roadmap/track for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam involves obtaining the CFE credential by passing the four-part CFE Exam, which includes Financial Transactions and Fraud Schemes, Law, Investigation, and Fraud Prevention and Deterrence.

What are the Topics ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam Covers?

The topics covered in the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam include types of financial fraud schemes, techniques for detecting and preventing fraud, the legal aspects of fraud examination, and the role of financial transactions in fraudulent activities.

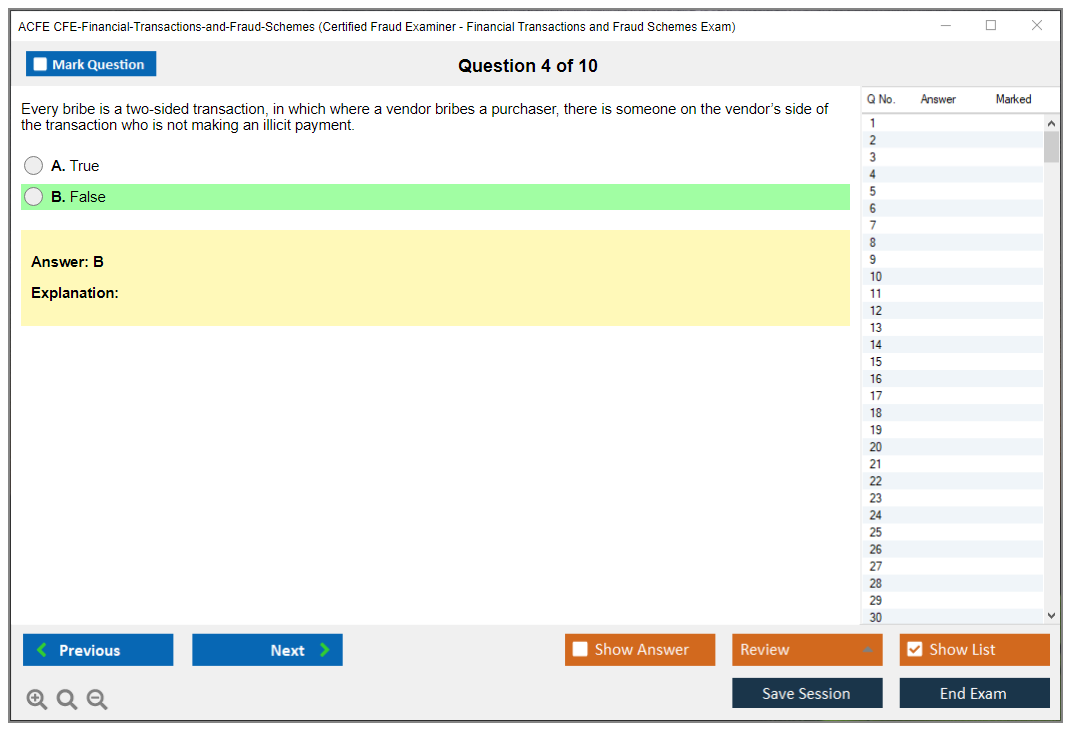

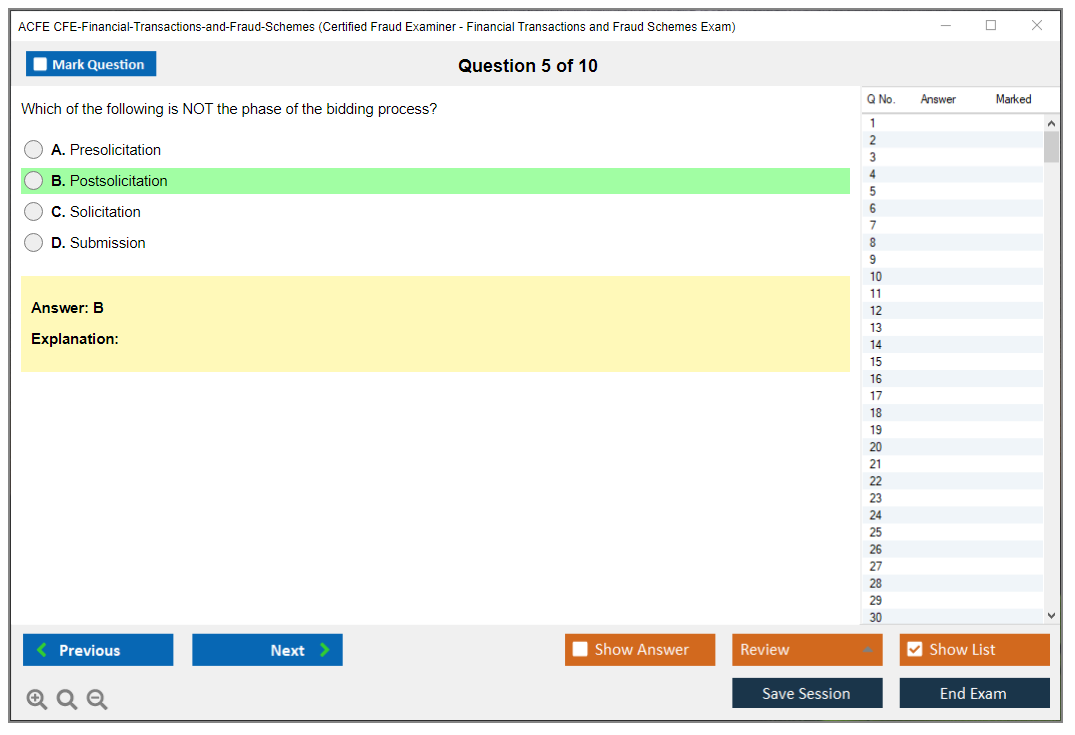

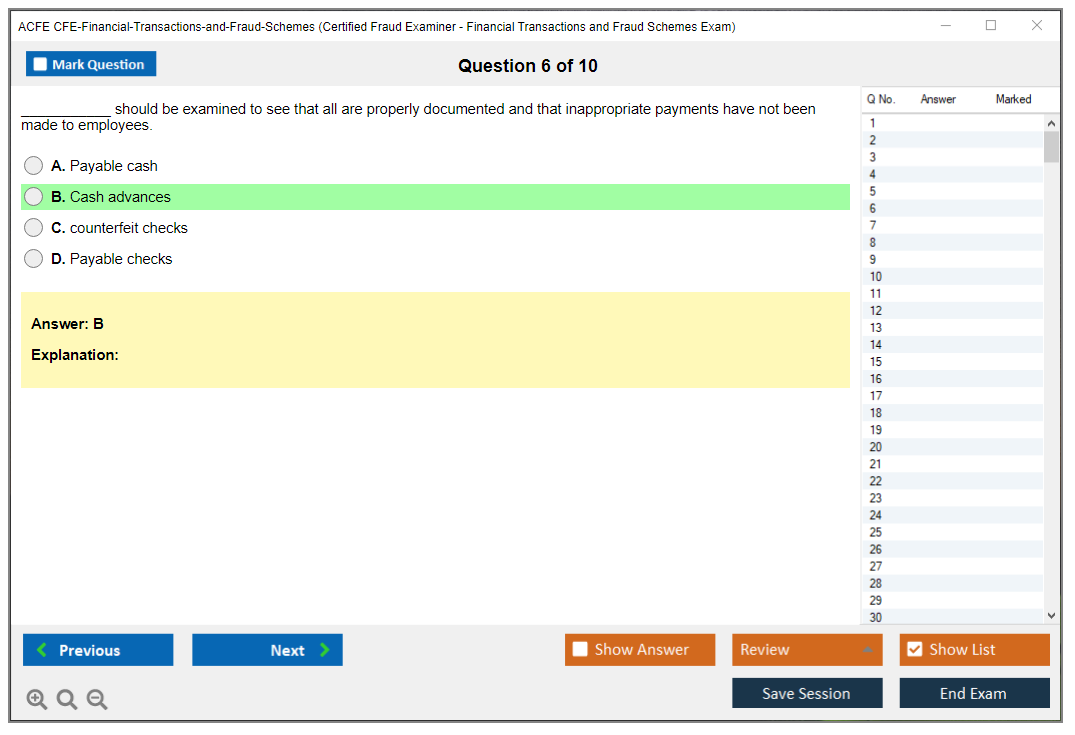

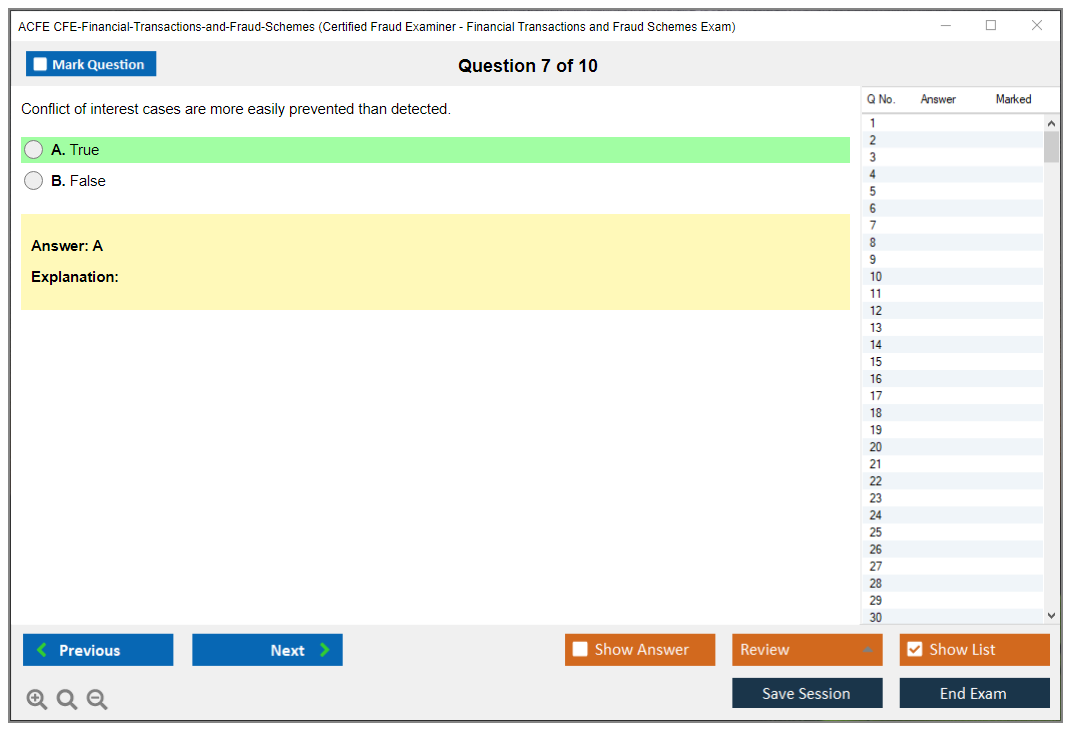

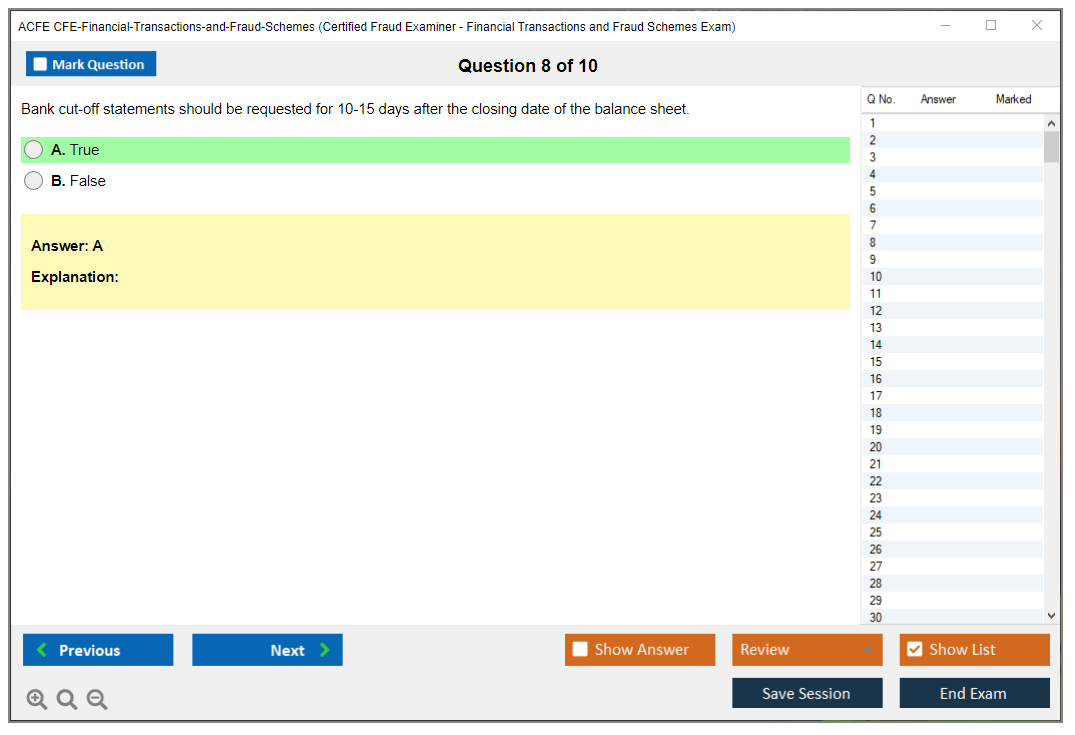

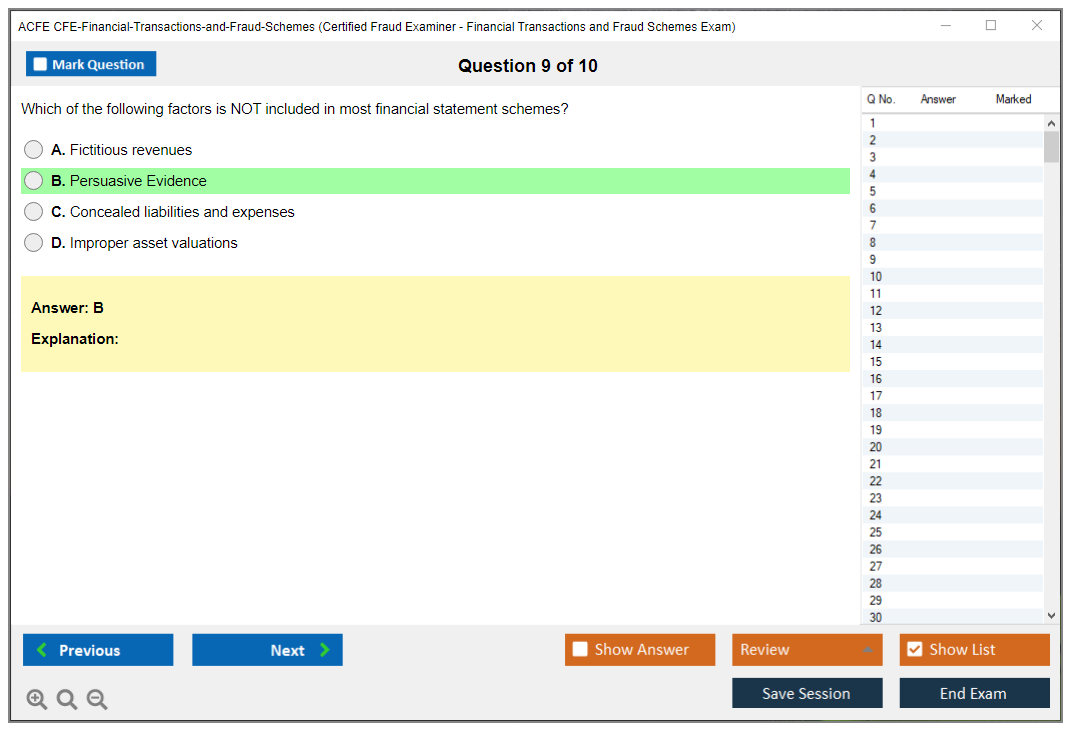

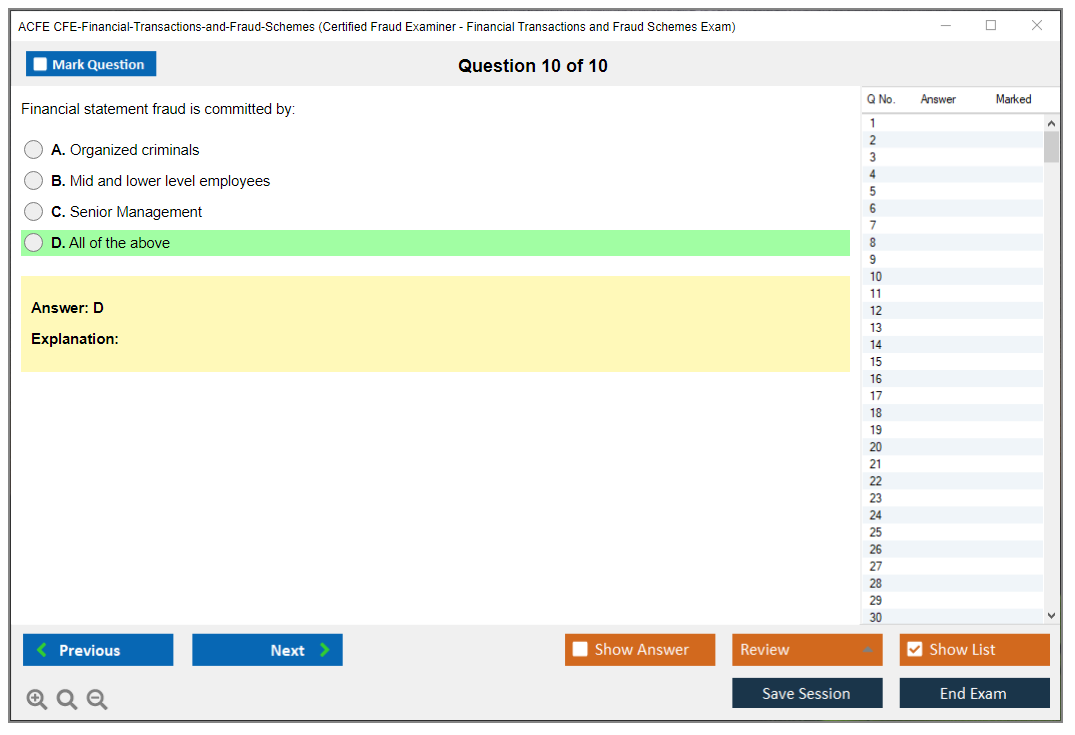

What are the Sample Questions of ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam?

Sample questions for the ACFE CFE-Financial-Transactions-and-Fraud-Schemes Exam can be found on the ACFE's official website and in study guides provided by the ACFE.