Introduction to the CompTIA SY0-701 Exam

The field of cybersecurity is continuously evolving, requiring professionals to stay updated with the latest technologies and security protocols. One of the most recognized certifications in this domain is the CompTIA Security+ SY0-701 exam. This certification validates the foundational knowledge and skills necessary for securing networks, managing risks, and implementing best practices in cybersecurity.

Earning the SY0-701 certification is crucial for IT professionals looking to establish or advance their careers in cybersecurity. The exam covers a wide range of topics, including risk management, incident response, secure network architecture, and cryptography. Understanding the fundamental aspects of cybersecurity, including secure data handling, is an essential part of preparing for this exam.

Definition of CompTIA SY0-701 Exam

The CompTIA Security+ SY0-701 exam is an entry-level certification exam designed to assess an individual’s ability to identify and mitigate security threats, implement security measures, and manage vulnerabilities. It is a globally recognized certification that covers the following domains:

- Threats, Attacks, and Vulnerabilities: Identifying common attack types, malware, and security threats.

- Architecture and Design: Implementing secure network and system architectures.

- Implementation: Deploying security solutions such as firewalls, endpoint security, and authentication methods.

- Operations and Incident Response: Managing security incidents and responding to threats effectively.

- Governance, Risk, and Compliance: Understanding security policies, legal frameworks, and compliance requirements.

The SY0-701 exam serves as a benchmark for cybersecurity professionals and is widely respected across industries. By passing this exam, candidates demonstrate their ability to apply security principles to protect organizations from cyber threats.

Understanding Floating-Point and Integer Data Types

Data types are fundamental in programming and database management, especially in financial and cybersecurity applications. Two common data types are floating-point numbers and integers:

- Floating-point numbers are used to represent numbers with decimals (e.g., 12.34, 99.99).

- Integers are whole numbers without fractional components (e.g., 10, 500, -7).

While both data types have their own advantages, choosing the right one for financial computations is critical. A deep understanding of these data types can help cybersecurity professionals prevent errors and vulnerabilities in financial applications.

Why Floating-Point Numbers Are Used for Monetary Values

Floating-point numbers are commonly used in financial applications for several reasons:

- Precision in Calculations: Monetary values often require decimal precision (e.g., $12.99 or €150.75). Floating-point representation allows accurate financial computations.

- Scalability: Floating-point arithmetic enables handling of large and small financial values efficiently.

- Mathematical Operations: Transactions involving interest rates, currency conversions, and percentage-based calculations often require floating-point operations to ensure accuracy.

- Standardization: Many programming languages and databases support floating-point arithmetic with built-in precision controls to minimize errors.

In financial applications, floating-point numbers ensure accurate representation and manipulation of values, reducing the risk of miscalculations due to rounding errors.

Why Integers Are Not Always Ideal for Storing Monetary Values

While integers may seem like a simpler alternative, they have certain limitations when dealing with monetary values:

- Lack of Decimal Support: Since integers cannot store fractional values, financial computations requiring cents or subunit precision may become inaccurate.

- Rounding Issues: Converting floating-point values to integers can lead to rounding errors, which may result in financial discrepancies.

- Limited Flexibility: Transactions often require precise decimal calculations, which integers cannot inherently support.

- Potential Security Risks: Improper handling of integer conversions may lead to vulnerabilities such as integer overflow or truncation errors.

In financial applications, using integers to store monetary values may lead to inaccurate calculations and security risks, making them less suitable than floating-point numbers.

Best Practices in Secure Financial Data Handling

When handling financial data, security and accuracy are paramount. Here are some best practices to ensure the secure management of monetary values:

- Use Fixed-Point Decimal Data Types: Instead of standard floating-point numbers, financial applications should use decimal data types (e.g., DECIMAL, NUMERIC in databases) to maintain accuracy.

- Implement Proper Rounding Methods: Ensure correct rounding strategies (e.g., round half-up or round half-down) to prevent calculation discrepancies.

- Use Secure Data Storage Techniques: Encrypt sensitive financial data at rest and in transit to protect against unauthorized access.

- Validate and Sanitize Inputs: Prevent injection attacks by validating and sanitizing financial data input fields.

- Perform Regular Security Audits: Conduct frequent security assessments to identify vulnerabilities in financial systems.

- Adopt Multi-Factor Authentication (MFA): Implement MFA for systems handling financial transactions to enhance security.

- Follow Compliance Standards: Adhere to industry standards such as PCI DSS (Payment Card Industry Data Security Standard) to ensure regulatory compliance.

By following these best practices, cybersecurity professionals can secure financial applications and prevent potential fraud, data breaches, and computational errors.

Conclusion

The CompTIA Security+ SY0-701 exam equips professionals with the knowledge required to manage cybersecurity risks, including best practices in financial data security. Understanding data types such as floating-point and integers is crucial in financial computations, ensuring accuracy and security in monetary transactions.

By using floating-point numbers appropriately, applying secure data handling practices, and implementing robust cybersecurity measures, organizations can protect financial data from vulnerabilities and fraud. Earning the CompTIA SY0-701 certification is a significant step toward mastering cybersecurity principles and advancing in the IT security field.

For individuals preparing for the SY0-701 exam, platforms like DumpsBoss provide valuable resources, including practice tests, study guides, and expert insights to help candidates succeed. Stay ahead in cybersecurity by obtaining your certification and enhancing your expertise in secure financial data management!

Special Discount: Offer Valid For Limited Time “SY0-701 Exam” Order Now!

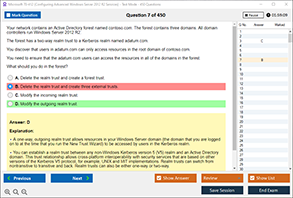

Sample Questions for CompTIA SY0-701 Dumps

Actual exam question from CompTIA SY0-701 Exam.

Which of the following best explains why float is used instead of an integer to store monetary values?

A. Floats require less memory compared to integers.

B. Floats provide higher precision, allowing for accurate representation of decimal values.

C. Integers cannot perform arithmetic operations.

D. Floats are faster in all calculations compared to integers.