Introduction to the CPA AA (Audit & Insurance) Exam

The CPA AA exam is designed to assess a candidate's knowledge and skills in auditing, attestation, and assurance services. It covers a wide range of topics, including audit planning, risk assessment, internal controls, audit evidence, and reporting. The exam also emphasizes the importance of understanding legal and regulatory requirements, as well as stakeholder expectations in the audit process.

The CPA AA exam is not just about memorizing concepts; it requires candidates to apply their knowledge to practical scenarios. This makes the exam particularly challenging, as it tests both theoretical understanding and practical application. For many candidates, the key to success lies in thorough preparation and the use of reliable study materials.

Why AZ-900 is the Best Microsoft Certification for Beginners

While the CPA AA exam focuses on auditing and attestation, it's worth noting that certifications like the Microsoft AZ-900 (Microsoft Azure Fundamentals) can complement your accounting and auditing skills. The AZ-900 certification is an excellent starting point for beginners in the tech world, as it provides a foundational understanding of cloud services and how they can be applied in various industries, including accounting and auditing.

For CPAs, understanding cloud-based tools and technologies is becoming increasingly important, as many organizations are transitioning to cloud-based accounting and auditing systems. By earning the AZ-900 certification, you can enhance your technical skills and make yourself more competitive in the job market. DumpsBoss offers comprehensive study materials for the AZ-900 exam, making it easier for beginners to prepare and pass the certification.

Understanding the Entity and Its Environment

One of the core components of the CPA AA exam is understanding the entity and its environment. This involves gaining a deep understanding of the organization being audited, including its internal controls, business processes, and industry-specific risks. Auditors must also consider the entity's objectives, strategies, and the external factors that could impact its financial statements.

DumpsBoss provides detailed study materials that cover this topic in depth, helping candidates develop a thorough understanding of how to assess an entity's environment. By using DumpsBoss, you can learn how to identify key risks and tailor your audit approach to address them effectively.

Audit Objectives

- The primary objective of an audit is to provide an independent opinion on the fairness and accuracy of an entity's financial statements. To achieve this, auditors must plan and execute the audit in accordance with professional standards, gather sufficient and appropriate audit evidence, and communicate their findings effectively.

- DumpsBoss offers practice questions and mock exams that simulate real-world audit scenarios, allowing candidates to test their understanding of audit objectives and refine their skills. With DumpsBoss, you can gain the confidence needed to tackle even the most complex audit questions on the CPA AA exam.

Materiality Considerations

- Materiality is a key concept in auditing, as it helps auditors determine the significance of misstatements in financial statements. Understanding materiality is essential for making informed decisions about the scope and focus of an audit.

- DumpsBoss provides clear explanations and examples of materiality considerations, helping candidates grasp this critical concept. By practicing with DumpsBoss materials, you can learn how to apply materiality thresholds in different audit scenarios and make sound judgments during the exam.

Risk Assessment

- Risk assessment is a fundamental part of the audit process. Auditors must identify and assess risks that could lead to material misstatements in financial statements. This involves understanding the entity's internal controls, evaluating the likelihood and impact of risks, and designing audit procedures to address those risks.

- DumpsBoss offers a variety of resources to help candidates master risk assessment, including detailed study guides and practice questions. With DumpsBoss, you can develop the skills needed to identify and respond to risks effectively, both on the exam and in your future career as a CPA.

Legal and Regulatory Requirements

- Auditors must have a thorough understanding of the legal and regulatory requirements that apply to the entity being audited. This includes knowledge of accounting standards, tax laws, and industry-specific regulations.

- DumpsBoss provides up-to-date information on legal and regulatory requirements, ensuring that candidates are well-prepared for this aspect of the CPA AA exam. By studying with DumpsBoss, you can stay informed about the latest developments in auditing standards and regulations.

Stakeholder Expectations

- Stakeholders, including shareholders, regulators, and management, rely on auditors to provide accurate and reliable information about an entity's financial health. Understanding stakeholder expectations is crucial for delivering high-quality audit services.

- DumpsBoss helps candidates develop the communication and interpersonal skills needed to meet stakeholder expectations. With DumpsBoss, you can learn how to present audit findings clearly and professionally, ensuring that you meet the needs of all stakeholders.

Practical Application in the Audit Process

The CPA AA exam places a strong emphasis on the practical application of auditing concepts. Candidates must be able to apply their knowledge to real-world scenarios, making decisions and solving problems based on the information provided.

DumpsBoss offers a wide range of practice questions and case studies that simulate real-world audit situations. By practicing with DumpsBoss materials, you can develop the critical thinking and problem-solving skills needed to excel on the CPA AA exam.

Common Challenges in Defining Audit Scope

Defining the scope of an audit can be challenging, as auditors must balance the need for thoroughness with the constraints of time and resources. Common challenges include identifying key risks, determining materiality thresholds, and selecting appropriate audit procedures.

DumpsBoss provides practical tips and strategies for defining audit scope effectively. With DumpsBoss, you can learn how to prioritize audit areas, allocate resources efficiently, and ensure that your audit is both comprehensive and cost-effective.

Exam-Taking Strategies for CPA AA Exam Questions

The CPA AA exam is known for its challenging questions, which often require candidates to analyze complex scenarios and apply their knowledge in creative ways. To succeed, candidates must develop effective exam-taking strategies, such as time management, question analysis, and answer elimination.

DumpsBoss offers a variety of resources to help candidates prepare for the exam, including timed practice tests and detailed answer explanations. By practicing with DumpsBoss materials, you can develop the skills and confidence needed to tackle even the most difficult CPA AA exam questions.

Conclusion

The CPA AA (Audit & Insurance) exam is a challenging but rewarding step on the path to becoming a Certified Public Accountant. With its focus on auditing, attestation, and assurance services, the exam requires a deep understanding of auditing concepts and the ability to apply them in practical scenarios.

DumpsBoss is the ultimate resource for CPA AA exam preparation, offering comprehensive study materials, practice questions, and exam-taking strategies. Whether you're just starting your CPA journey or looking to refine your skills, DumpsBoss can help you achieve your goals and unlock success on the CPA AA exam.

By leveraging the resources and expertise provided by DumpsBoss, you can approach the CPA AA exam with confidence, knowing that you have the knowledge and skills needed to succeed. So, take the first step toward your CPA designation today and start your journey with DumpsBoss!

Special Discount: Offer Valid For Limited Time “AA (Audit & Insurance) Exam” Order Now!

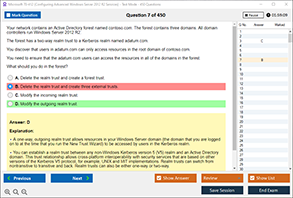

Sample Questions for CPA AA Dumps

Actual exam question from CPA AA Exam.

Which of the following is important in defining the scope of the audit process?

a) The color of the audit report

b) The objectives and boundaries of the audit

c) The number of auditors in the team

d) The type of software used for documentation