Introduction to the Test Prep CFA-Level-1 Exam

The CFA-Level-1 exam is the first of three exams required to earn the CFA charter. It is designed to test candidates on their knowledge of investment tools, ethical and professional standards, and the fundamentals of financial analysis. The exam consists of 180 multiple-choice questions divided into two sessions, covering ten topic areas, including ethics, quantitative methods, economics, financial reporting, and portfolio management.

Passing the CFA-Level-1 exam is no small feat. It requires a deep understanding of complex financial concepts, strong analytical skills, and a commitment to ethical decision-making. This is where DumpsBoss comes in. DumpsBoss is a leading provider of test preparation materials, offering comprehensive study guides, practice questions, and mock exams tailored to the CFA-Level-1 curriculum. With DumpsBoss, candidates can confidently approach the exam, knowing they have the resources to succeed.

Definition of Test Prep CFA-Level-1 Exam

The CFA-Level-1 exam is a standardized test administered by the CFA Institute. It assesses a candidate's ability to apply foundational knowledge and skills in real-world investment scenarios. The exam is divided into two 135-minute sessions, with a break in between. The first session focuses on ethical and professional standards, quantitative methods, economics, and financial reporting. The second session covers corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

What sets the CFA-Level-1 exam apart is its emphasis on ethics. The CFA Institute places a strong emphasis on ethical behavior, as it is the cornerstone of trust and integrity in the finance industry. Candidates are expected to demonstrate not only technical proficiency but also a commitment to ethical decision-making.

Understanding Business Ethics

Business ethics refers to the moral principles and values that guide behavior in the world of business. In the context of the CFA-Level-1 exam, ethics is a critical topic area that candidates must master. Ethical behavior is essential in finance because it builds trust between professionals, clients, and the public. Without trust, the financial system cannot function effectively.

Ethics in finance involves making decisions that are not only legally compliant but also morally sound. This includes avoiding conflicts of interest, maintaining confidentiality, and acting in the best interests of clients. The CFA-Level-1 exam tests candidates on their ability to identify ethical dilemmas, apply ethical principles, and make decisions that align with the CFA Institute's Code of Ethics and Standards of Professional Conduct.

Key Principles Guiding Ethical Behavior in Business

Several key principles guide ethical behavior in business, and these are particularly relevant to the CFA-Level-1 exam. These principles include:

- Integrity: Acting with honesty and transparency in all professional dealings.

- Objectivity: Making decisions based on facts and analysis, free from bias or personal interests.

- Professional Competence: Maintaining and improving professional knowledge and skills.

- Confidentiality: Protecting sensitive information and using it only for authorized purposes.

- Fairness: Treating all parties equitably and avoiding favoritism or discrimination.

- Diligence: Performing duties with care, thoroughness, and timeliness.

These principles form the foundation of ethical behavior in finance and are integral to the CFA-Level-1 exam. Candidates must understand how to apply these principles in real-world scenarios, such as managing client portfolios, conducting financial analysis, and making investment recommendations.

Ethical Frameworks and Guidelines

To help candidates navigate ethical dilemmas, the CFA Institute provides a comprehensive framework for ethical decision-making. This framework includes:

- Identifying Ethical Issues: Recognizing situations that have ethical implications.

- Evaluating Alternatives: Considering the potential consequences of different actions.

- Applying Ethical Principles: Using the CFA Institute's Code of Ethics and Standards of Professional Conduct to guide decision-making.

- Making a Decision: Choosing the course of action that aligns with ethical principles.

- Reflecting on the Outcome: Assessing the impact of the decision and learning from the experience.

This framework is a valuable tool for CFA-Level-1 candidates, as it helps them approach ethical questions systematically and confidently. By practicing with DumpsBoss's ethical scenario-based questions, candidates can develop the skills needed to excel in this area of the exam.

CFA Institute Code of Ethics and Standards of Professional Conduct

The CFA Institute's Code of Ethics and Standards of Professional Conduct is a cornerstone of the CFA program. It outlines the ethical responsibilities of CFA charterholders and candidates, emphasizing the importance of integrity, professionalism, and accountability. The Code of Ethics includes six key principles:

- Act with integrity, competence, diligence, respect, and in an ethical manner.

- Place the integrity of the investment profession and the interests of clients above personal interests.

- Use reasonable care and exercise independent professional judgment.

- Practice and encourage others to practice in a professional and ethical manner.

- Promote the integrity and viability of the global capital markets for the ultimate benefit of society.

- Maintain and improve professional competence.

The Standards of Professional Conduct provide specific guidelines for ethical behavior, including duties to clients, employers, and the public. These standards are a key focus of the CFA-Level-1 exam, and candidates must demonstrate a thorough understanding of them.

DumpsBoss offers detailed study materials that break down the Code of Ethics and Standards of Professional Conduct into manageable sections. With practice questions and explanations, candidates can reinforce their understanding and apply these principles to exam scenarios.

Conclusion

The CFA-Level-1 exam is a challenging but rewarding step toward earning the CFA charter. Success on the exam requires not only technical knowledge but also a strong foundation in ethics. By understanding the principles of business ethics, the CFA Institute's ethical framework, and the Code of Ethics and Standards of Professional Conduct, candidates can approach the exam with confidence.

DumpsBoss is an invaluable resource for CFA-Level-1 candidates, providing comprehensive study materials, practice questions, and mock exams. With DumpsBoss, you can master the ethical and technical aspects of the exam, ensuring you are well-prepared to pass and move closer to earning your CFA charter.

As you embark on your CFA journey, remember that ethical behavior is not just a requirement for the exam—it is a lifelong commitment to integrity and professionalism in the finance industry. With the right preparation and resources, you can achieve your goals and make a positive impact in the world of finance. Trust DumpsBoss to guide you every step of the way.

Special Discount: Offer Valid For Limited Time “CFA-Level-1 Exam” Order Now!

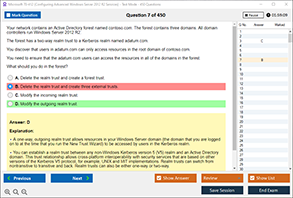

Sample Questions for Test Prep CFA-Level-1 Dumps

Actual exam question from Test Prep CFA-Level-1 Exam.

Which of the following should guide ethical behavior in a business?

A) Profit maximization at any cost

B) Personal interests of the CEO

C) Legal compliance and moral principles

D) Market competition alone