Introduction to the ACAMS CAMS Exam

The financial industry is constantly evolving, and with it, the methods used to launder money and finance illicit activities. To combat these threats, professionals in the field of anti-money laundering (AML) must stay ahead of the curve. The Certified Anti-Money Laundering Specialist (CAMS) certification, offered by the Association of Certified Anti-Money Laundering Specialists (ACAMS), is the gold standard for AML professionals. The CAMS exam (6th Edition) is designed to test your knowledge of AML principles, practices, and regulations, ensuring you are well-equipped to identify and prevent financial crimes.

One of the key areas covered in the CAMS exam is the identification of suspicious payment methods. Understanding these methods is crucial for AML professionals, as they are often the first line of defense against money laundering and terrorist financing. In this blog, we will delve into the intricacies of suspicious payment methods, provide examples, and offer strategies to help you ace this section of the CAMS exam.

Definition of CAMS (Certified Anti-Money Laundering Specialist (6th Edition))

The CAMS certification is a globally recognized credential that validates your expertise in AML and counter-terrorist financing (CTF). The 6th Edition of the CAMS exam reflects the latest developments in the field, including updated regulations, emerging risks, and advanced techniques used by criminals to launder money.

- The exam consists of 120 multiple-choice questions, covering four main domains:

- AML/CFT Compliance Programs

- Risk Management

- Conducting and Supporting Investigations

- AML/CFT in the Financial Sector

A significant portion of the exam focuses on identifying and analyzing suspicious payment methods, making it essential for candidates to have a thorough understanding of this topic.

Understanding Suspicious Payment Methods

Suspicious payment methods are transactions or financial activities that exhibit red flags indicating potential money laundering, terrorist financing, or other illicit activities. These methods often deviate from normal business practices and lack a clear economic or legal purpose. Financial institutions and AML professionals are trained to identify these anomalies to prevent criminals from exploiting the financial system.

Common Characteristics of Suspicious Payment Methods

- Unusual Transaction Patterns: Transactions that are inconsistent with a customer’s typical behavior, such as sudden large deposits or withdrawals, can be a red flag.

- Lack of Transparency: Payments involving shell companies, offshore accounts, or entities with unclear ownership structures are often suspicious.

- High-Risk Jurisdictions: Transactions linked to countries known for weak AML regulations or high levels of corruption should be scrutinized.

- Frequent Use of Cash: Large cash transactions or the use of cash in industries where it is uncommon can indicate attempts to avoid detection.

- Structuring (Smurfing): Breaking down large transactions into smaller amounts to avoid reporting thresholds is a common money laundering tactic.

- Unrelated Third-Party Involvement: Payments involving third parties with no apparent connection to the transaction or business relationship can be suspicious.

Examples of Suspicious Payment Methods

Cryptocurrency Transactions: While cryptocurrencies are legitimate, their anonymity and lack of regulation make them attractive for money laundering. Unexplained or large crypto transactions should be investigated.

- Trade-Based Money Laundering: Over- or under-invoicing goods and services to move money across borders is a common method.

- Wire Transfers to High-Risk Countries: Frequent or large wire transfers to jurisdictions with weak AML controls can indicate illicit activity.

- Prepaid Cards: These can be used to store and transfer illicit funds anonymously.

- Casino Chips: Purchasing and redeeming casino chips without gambling can be a way to launder money.

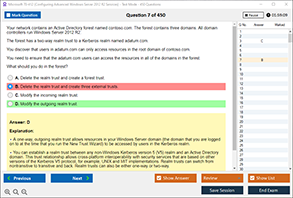

Analyzing the Exam Question

The CAMS exam often includes scenario-based questions that require candidates to identify suspicious payment methods. For example, a question might describe a series of transactions and ask which one is most likely to be suspicious. To answer such questions effectively, candidates must:

- Understand the Context: Analyze the scenario for details about the customer, transaction patterns, and any red flags.

- Apply AML Principles: Use your knowledge of common money laundering techniques and suspicious payment methods to evaluate the options.

- Eliminate Non-Suspicious Options: Rule out transactions that align with legitimate business practices.

Examples of Non-Suspicious Payment Methods

Not all unusual transactions are suspicious. Legitimate payment methods often have clear economic purposes and align with a customer’s profile. Examples include:

- Salary Payments: Regular payroll transactions from an employer to an employee.

- Utility Bills: Monthly payments for services like electricity, water, or internet.

- Loan Repayments: Scheduled payments to a bank or financial institution.

- Retail Purchases: Everyday transactions using credit cards, debit cards, or digital wallets.

Characteristics of Non-Suspicious Payments

- Consistency: Transactions align with the customer’s known financial behavior.

- Transparency: The purpose and parties involved are clear and documented.

- Legitimacy: The transaction has a lawful economic purpose.

- Low Risk: The payment method and jurisdiction are not associated with high-risk activities.

Strategies for Answering Similar Exam Questions

- Study the CAMS Exam Outline: Familiarize yourself with the topics covered in the exam, including suspicious payment methods, AML regulations, and risk assessment.

- Use Practice Questions: Resources like DumpsBoss provide realistic practice questions that mimic the exam format, helping you build confidence and improve your problem-solving skills.

- Understand Key Concepts: Focus on understanding the principles behind AML regulations and how they apply to real-world scenarios.

- Time Management: Practice answering questions within the allotted time to ensure you can complete the exam efficiently.

- Review Incorrect Answers: Analyze your mistakes to identify areas where you need further study.

The Role of DumpsBoss in CAMS Exam Preparation

Preparing for the CAMS exam can be challenging, but resources like DumpsBoss make the process more manageable. DumpsBoss offers a comprehensive collection of practice questions, study materials, and exam tips tailored to the CAMS certification. Here’s how DumpsBoss can help you succeed:

- Realistic Practice Questions: DumpsBoss provides up-to-date questions that reflect the latest exam content and format.

- Detailed Explanations: Each question comes with a thorough explanation, helping you understand the reasoning behind the correct answer.

- Customizable Study Plans: DumpsBoss allows you to create a study plan that fits your schedule and learning style.

- Performance Tracking: Monitor your progress and identify areas for improvement with DumpsBoss analytics tools.

- Expert Guidance: Access tips and strategies from AML professionals who have successfully passed the CAMS exam.

By leveraging DumpsBoss resources, you can build the knowledge and confidence needed to excel on the CAMS exam.

Conclusion

The ACAMS CAMS exam is a critical step for professionals seeking to advance their careers in AML and financial crime prevention. Understanding suspicious payment methods is a key component of the exam, requiring candidates to differentiate between legitimate and illicit transactions. By studying the characteristics of suspicious and non-suspicious payments, practicing with realistic questions, and utilizing resources like DumpsBoss, you can enhance your preparation and increase your chances of success.

As financial crimes continue to evolve, the demand for certified AML specialists will only grow. Earning the CAMS certification not only validates your expertise but also positions you as a valuable asset in the fight against money laundering and terrorist financing. With dedication, the right study materials, and a strategic approach, you can master the CAMS exam and take your career to new heights.

Special Discount: Offer Valid For Limited Time “CAMS Exam” Order Now!

Sample Questions for ACAMS CAMS Dumps

Actual exam question from ACAMS CAMS Exam.

Which of the following would not be a suspicious method of payment red flag?

A) Payment made in small, unusual denominations (e.g., mostly $1 bills)

B) Payment via a verified and traceable bank transfer

C) Payment using multiple prepaid gift cards

D) Payment from a high-risk country with no clear business connection