Pass CPA Australia Financial-Accounting-and-Reporting Exam in First Attempt with DumpsBoss Practice Exam Dumps!

- Certification Provider: CPA Australia

- Certification: CPA Foundation Program

- Exclusive Limited Sale Offer!

55-85% OFF

Hurry up! offer ends in 00 Days 00h 00m 00s

*Download FREE Test Engine Player

Introduction of CPA Australia Financial-Accounting-and-Reporting Exam!

The CPA Australia Financial-Accounting-and-Reporting Exam is a component of the CPA Program, aimed at evaluating the proficiency of candidates in the areas of financial accounting and reporting. This exam helps ensure that individuals possess the necessary skills and knowledge to perform effectively in the accounting profession.

What is the Duration of CPA Australia Financial-Accounting-and-Reporting Exam?

The CPA Australia Financial-Accounting-and-Reporting (CPA Financial Accounting and Reporting Exam) is a professional certification exam designed to assess the knowledge and skills of candidates in financial accounting and reporting. It is a part of the CPA Program, which is intended to develop and recognize the expertise of accounting professionals.

What are the Number of Questions Asked in CPA Australia Financial-Accounting-and-Reporting Exam?

The number of questions asked in the CPA Australia Financial-Accounting-and-Reporting Exam typically varies, but candidates can expect around 100 multiple-choice questions along with other types of questions such as written responses or case studies.

What is the Passing Score for CPA Australia Financial-Accounting-and-Reporting Exam?

The passing score for the CPA Australia Financial-Accounting-and-Reporting Exam is generally set at 540 out of a possible 900 points.

What is the Competency Level required for CPA Australia Financial-Accounting-and-Reporting Exam?

The competency level required for the CPA Australia Financial-Accounting-and-Reporting Exam includes a strong understanding of accounting principles and practices, financial reporting standards, and the ability to apply this knowledge in practical scenarios.

What is the Question Format of CPA Australia Financial-Accounting-and-Reporting Exam?

The question format of the CPA Australia Financial-Accounting-and-Reporting Exam includes multiple-choice questions, written responses, and case studies to assess a candidate's comprehensive understanding of financial accounting and reporting.

How Can You Take CPA Australia Financial-Accounting-and-Reporting Exam?

The CPA Australia Financial-Accounting-and-Reporting Exam can be taken at designated testing centers or online, depending on the availability and the candidate's preference.

What Language CPA Australia Financial-Accounting-and-Reporting Exam is Offered?

The CPA Australia Financial-Accounting-and-Reporting Exam is offered in English.

What is the Cost of CPA Australia Financial-Accounting-and-Reporting Exam?

The cost of the CPA Australia Financial-Accounting-and-Reporting Exam varies depending on the region and membership status, but it typically ranges from AUD 1,000 to AUD 1,500.

What is the Target Audience of CPA Australia Financial-Accounting-and-Reporting Exam?

The target audience for the CPA Australia Financial-Accounting-and-Reporting Exam includes accounting professionals, finance managers, auditors, and individuals seeking to advance their careers in accounting and financial reporting.

What is the Average Salary of CPA Australia Financial-Accounting-and-Reporting Certified in the Market?

The average salary of a CPA Australia Financial-Accounting-and-Reporting certified professional can vary widely based on experience, location, and job role, but it generally ranges from AUD 70,000 to AUD 120,000 per year.

Who are the Testing Providers of CPA Australia Financial-Accounting-and-Reporting Exam?

The testing providers for the CPA Australia Financial-Accounting-and-Reporting Exam are authorized Pearson VUE testing centers and CPA Australia's online testing platform.

What is the Recommended Experience for CPA Australia Financial-Accounting-and-Reporting Exam?

The recommended experience for the CPA Australia Financial-Accounting-and-Reporting Exam includes a strong educational background in accounting and finance, along with practical experience in financial reporting and accounting roles.

What are the Prerequisites of CPA Australia Financial-Accounting-and-Reporting Exam?

The prerequisites for the CPA Australia Financial-Accounting-and-Reporting Exam include membership with CPA Australia and completion of the required foundation exams or equivalent qualifications.

What is the Expected Retirement Date of CPA Australia Financial-Accounting-and-Reporting Exam?

There is currently no specified retirement date for the CPA Australia Financial-Accounting-and-Reporting Exam, but candidates should stay updated with CPA Australia's announcements for any changes.

What is the Difficulty Level of CPA Australia Financial-Accounting-and-Reporting Exam?

The difficulty level of the CPA Australia Financial-Accounting-and-Reporting Exam is considered to be challenging, requiring a thorough understanding of accounting principles, standards, and practical application skills.

What is the Roadmap / Track of CPA Australia Financial-Accounting-and-Reporting Exam?

The roadmap/track of the CPA Australia Financial-Accounting-and-Reporting Exam involves completing the CPA Program, which includes a series of exams and practical experience requirements, culminating in the CPA designation.

What are the Topics CPA Australia Financial-Accounting-and-Reporting Exam Covers?

The topics covered in the CPA Australia Financial-Accounting-and-Reporting Exam include financial reporting, accounting standards, financial statement analysis, regulatory frameworks, and ethical considerations in financial reporting.

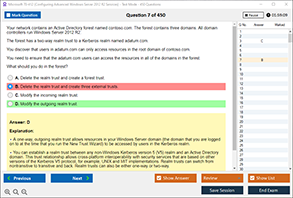

What are the Sample Questions of CPA Australia Financial-Accounting-and-Reporting Exam?

Sample questions for the CPA Australia Financial-Accounting-and-Reporting Exam can be found on the CPA Australia website and in official study materials provided by CPA Australia.