Pass GAQM CGTP-001 Exam in First Attempt with DumpsBoss Practice Exam Dumps!

- Certification Provider: GAQM

- Certification: GAQM: Finance And Accounting

- Exclusive Limited Sale Offer!

55-85% OFF

Hurry up! offer ends in 00 Days 00h 00m 00s

*Download FREE Test Engine Player

Introduction of GAQM CGTP-001 Exam!

The GAQM CGTP-001 (Certified Global Tax Practitioner) exam is a certification exam that assesses the competency of candidates in global tax practices. It covers various aspects of international tax laws, compliance, and planning, providing a comprehensive understanding of global tax systems.

What is the Duration of GAQM CGTP-001 Exam?

The GAQM CGTP-001 (Certified Global Tax Practitioner) exam is designed to validate the knowledge and skills of professionals in the field of global tax practices. It is a certification program offered by the Global Association for Quality Management (GAQM) aimed at professionals who handle international tax matters.

What are the Number of Questions Asked in GAQM CGTP-001 Exam?

The GAQM CGTP-001 exam typically consists of 50 questions.

What is the Passing Score for GAQM CGTP-001 Exam?

The passing score for the GAQM CGTP-001 exam is 70%.

What is the Competency Level required for GAQM CGTP-001 Exam?

The competency level required for the GAQM CGTP-001 exam is intermediate to advanced, depending on the candidate's prior experience and knowledge in global tax practices.

What is the Question Format of GAQM CGTP-001 Exam?

The question format of the GAQM CGTP-001 exam includes multiple-choice questions.

How Can You Take GAQM CGTP-001 Exam?

The GAQM CGTP-001 exam can be taken online through the GAQM's official website or through authorized testing centers.

What Language GAQM CGTP-001 Exam is Offered?

The GAQM CGTP-001 exam is offered in English.

What is the Cost of GAQM CGTP-001 Exam?

The cost of the GAQM CGTP-001 exam varies, but it is generally around $200 USD.

What is the Target Audience of GAQM CGTP-001 Exam?

The target audience for the GAQM CGTP-001 exam includes tax professionals, accountants, financial advisors, and other professionals involved in international tax matters.

What is the Average Salary of GAQM CGTP-001 Certified in the Market?

The average salary of a GAQM CGTP-001 certified professional can vary widely based on location and experience, but it typically ranges from $60,000 to $120,000 per year.

Who are the Testing Providers of GAQM CGTP-001 Exam?

The testing providers for the GAQM CGTP-001 exam include GAQM's official website and authorized testing centers.

What is the Recommended Experience for GAQM CGTP-001 Exam?

The recommended experience for the GAQM CGTP-001 exam includes a background in tax practices, accounting, or finance, with some experience in international tax matters.

What are the Prerequisites of GAQM CGTP-001 Exam?

There are no formal prerequisites for the GAQM CGTP-001 exam, but a background in tax practices or related fields is beneficial.

What is the Expected Retirement Date of GAQM CGTP-001 Exam?

The expected retirement date of the GAQM CGTP-001 exam is not specified and depends on updates from GAQM.

What is the Difficulty Level of GAQM CGTP-001 Exam?

The difficulty level of the GAQM CGTP-001 exam is considered to be intermediate to advanced, depending on the candidate's prior knowledge and experience in global tax practices.

What is the Roadmap / Track of GAQM CGTP-001 Exam?

The roadmap for the GAQM CGTP-001 exam includes gaining foundational knowledge in global tax practices, followed by advanced studies and practical experience in international tax matters.

What are the Topics GAQM CGTP-001 Exam Covers?

The topics covered in the GAQM CGTP-001 exam include international tax laws, compliance, tax planning, cross-border transactions, transfer pricing, and tax treaties.

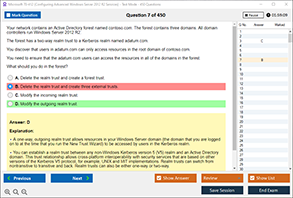

What are the Sample Questions of GAQM CGTP-001 Exam?

Sample questions for the GAQM CGTP-001 exam can be found on the GAQM's official website or through authorized study materials.