Pass GARP ICBRR Exam in First Attempt with DumpsBoss Practice Exam Dumps!

- Premium PDF & Test Engine Files with 341 Questions & Answers

- Certification Provider: GARP

- Certification: GARP Certification

Note: GARP ICBRR (International Certificate in Banking Risk and Regulation (ICBRR)) will not receive any new updates.

The new exam code is 2016-FRR

Introduction of GARP ICBRR Exam!

The GARP ICBRR Exam is a certification exam that evaluates a candidate's knowledge and understanding of banking risk management and regulatory principles. It covers various topics related to risk management, regulatory frameworks, and best practices in the banking industry.

What is the Duration of GARP ICBRR Exam?

The GARP International Certificate in Banking Risk and Regulation (ICBRR) is a professional certification designed to provide individuals with a comprehensive understanding of banking risk and regulation. It is offered by the Global Association of Risk Professionals (GARP) and aims to enhance the knowledge and skills of professionals in the banking sector.

What are the Number of Questions Asked in GARP ICBRR Exam?

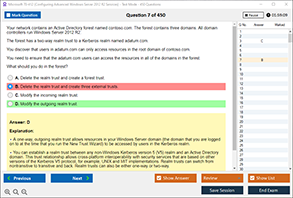

The GARP ICBRR Exam typically consists of 80 multiple-choice questions.

What is the Passing Score for GARP ICBRR Exam?

The passing score for the GARP ICBRR Exam is generally set at 70%.

What is the Competency Level required for GARP ICBRR Exam?

The competency level required for the GARP ICBRR Exam is intermediate to advanced, as it is designed for professionals with some experience in banking risk and regulation.

What is the Question Format of GARP ICBRR Exam?

The question format of the GARP ICBRR Exam is multiple-choice.

How Can You Take GARP ICBRR Exam?

The GARP ICBRR Exam can be taken online or at designated testing centers around the world.

What Language GARP ICBRR Exam is Offered?

The GARP ICBRR Exam is offered in English.

What is the Cost of GARP ICBRR Exam?

The cost of the GARP ICBRR Exam varies depending on the registration period and membership status with GARP. As of the latest information, the exam fee is approximately $650 for GARP members and $750 for non-members.

What is the Target Audience of GARP ICBRR Exam?

The target audience of the GARP ICBRR Exam includes banking professionals, risk managers, compliance officers, regulatory analysts, and other individuals involved in banking risk management and regulation.

What is the Average Salary of GARP ICBRR Certified in the Market?

The average salary of a GARP ICBRR certified professional varies based on experience, location, and job role. However, it is generally observed that certified professionals can earn between $80,000 to $120,000 annually.

Who are the Testing Providers of GARP ICBRR Exam?

The testing providers of the GARP ICBRR Exam include Pearson VUE and other authorized testing centers.

What is the Recommended Experience for GARP ICBRR Exam?

The recommended experience for the GARP ICBRR Exam includes a background in banking, finance, risk management, or related fields, with at least 2-3 years of professional experience.

What are the Prerequisites of GARP ICBRR Exam?

There are no formal prerequisites for the GARP ICBRR Exam, but a foundational understanding of banking and risk management principles is highly recommended.

What is the Expected Retirement Date of GARP ICBRR Exam?

The expected retirement date of the GARP ICBRR Exam is not specified, as it depends on updates and changes in the certification program by GARP.

What is the Difficulty Level of GARP ICBRR Exam?

The difficulty level of the GARP ICBRR Exam is considered to be moderate to high, requiring a thorough understanding of banking risk and regulation concepts.

What is the Roadmap / Track of GARP ICBRR Exam?

The roadmap/track of the GARP ICBRR Exam involves preparing for the exam through study materials and training programs, passing the exam, and maintaining the certification through continuing professional development.

What are the Topics GARP ICBRR Exam Covers?

The GARP ICBRR Exam covers topics such as risk management frameworks, regulatory environments, credit risk, market risk, operational risk, liquidity risk, and capital adequacy.

What are the Sample Questions of GARP ICBRR Exam?

Sample questions for the GARP ICBRR Exam can be found on the GARP website or through official study materials and practice exams provided by GARP.