Pass Test Prep CPA-Test Exam in First Attempt with DumpsBoss Practice Exam Dumps!

- Last Update Check: Mar 19, 2025

- Premium PDF & Test Engine Files with 1241 Questions & Answers

- Training Course 45 Lectures (10 Hours) - Course Overview

- Certification Provider: Test Prep

- Certification: Test Prep Certifications

- Exclusive Limited Sale Offer!

55-85% OFF

Hurry up! offer ends in 00 Days 00h 00m 00s

*Download FREE Test Engine Player

Most Popular

Printable PDF & Test Engine File Bundle

Introduction of Test Prep CPA-Test Exam!

The CPA Exam is a comprehensive assessment designed to evaluate the knowledge and skills required for the accounting profession. It is divided into four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section covers specific topics relevant to the practice of public accounting.

What is the Duration of Test Prep CPA-Test Exam?

The CPA Exam, formally known as the Uniform Certified Public Accountant Examination, is a professional licensure assessment administered by the American Institute of Certified Public Accountants (AICPA). It consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The exam tests a candidate's knowledge and skills necessary for entry-level CPAs.

What are the Number of Questions Asked in Test Prep CPA-Test Exam?

Each section of the CPA Exam consists of a different number of questions. Typically, each section includes multiple-choice questions (MCQs), task-based simulations (TBSs), and written communication tasks (WCTs) for the BEC section.

What is the Passing Score for Test Prep CPA-Test Exam?

The passing score for each section of the CPA Exam is 75 on a scale of 0-99.

What is the Competency Level required for Test Prep CPA-Test Exam?

The CPA Exam requires a high level of competency in accounting principles, auditing standards, business concepts, and regulatory guidelines. Candidates are expected to have a thorough understanding of the subjects covered in each section.

What is the Question Format of Test Prep CPA-Test Exam?

The CPA Exam includes multiple-choice questions (MCQs), task-based simulations (TBSs), and written communication tasks (WCTs). The BEC section includes written communication tasks, while the other sections include MCQs and TBSs.

How Can You Take Test Prep CPA-Test Exam?

The CPA Exam is administered at Prometric test centers throughout the United States and in select international locations. Candidates must apply through their state board of accountancy or NASBA (National Association of State Boards of Accountancy) to schedule their exams.

What Language Test Prep CPA-Test Exam is Offered?

The CPA Exam is offered in English.

What is the Cost of Test Prep CPA-Test Exam?

The cost of the CPA Exam varies by state and jurisdiction. Generally, candidates can expect to pay between $200 and $300 per section, in addition to application and registration fees.

What is the Target Audience of Test Prep CPA-Test Exam?

The target audience for the CPA Exam includes individuals seeking to become licensed Certified Public Accountants (CPAs). This typically includes accounting graduates, professionals in the accounting field, and individuals looking to advance their careers in accounting and finance.

What is the Average Salary of Test Prep CPA-Test Certified in the Market?

The average salary for a CPA varies based on experience, location, and industry. On average, CPAs can expect to earn between $60,000 and $120,000 per year, with potential for higher earnings as they gain experience and take on more advanced roles.

Who are the Testing Providers of Test Prep CPA-Test Exam?

The CPA Exam is administered by the American Institute of Certified Public Accountants (AICPA) in partnership with the National Association of State Boards of Accountancy (NASBA) and Prometric test centers.

What is the Recommended Experience for Test Prep CPA-Test Exam?

It is recommended that candidates have a bachelor's degree in accounting or a related field, along with relevant coursework in accounting, auditing, and business. Practical experience in the accounting field is also beneficial.

What are the Prerequisites of Test Prep CPA-Test Exam?

Prerequisites for the CPA Exam vary by state, but generally include a bachelor's degree with a specified number of accounting and business-related credits. Some states may also require candidates to have a certain amount of work experience under the supervision of a licensed CPA.

What is the Expected Retirement Date of Test Prep CPA-Test Exam?

The CPA Exam does not have a specific retirement date as it is continuously updated to reflect changes in the accounting profession and regulatory environment. However, candidates should be aware of changes to exam content and format that may occur periodically.

What is the Difficulty Level of Test Prep CPA-Test Exam?

The CPA Exam is considered to be quite challenging, with a rigorous testing process that requires a thorough understanding of accounting principles, auditing standards, business concepts, and regulatory guidelines. Proper preparation and study are essential for success.

What is the Roadmap / Track of Test Prep CPA-Test Exam?

The CPA Exam is part of the pathway to becoming a licensed CPA. After passing all four sections of the exam, candidates must also meet education and experience requirements set by their state board of accountancy to obtain licensure.

What are the Topics Test Prep CPA-Test Exam Covers?

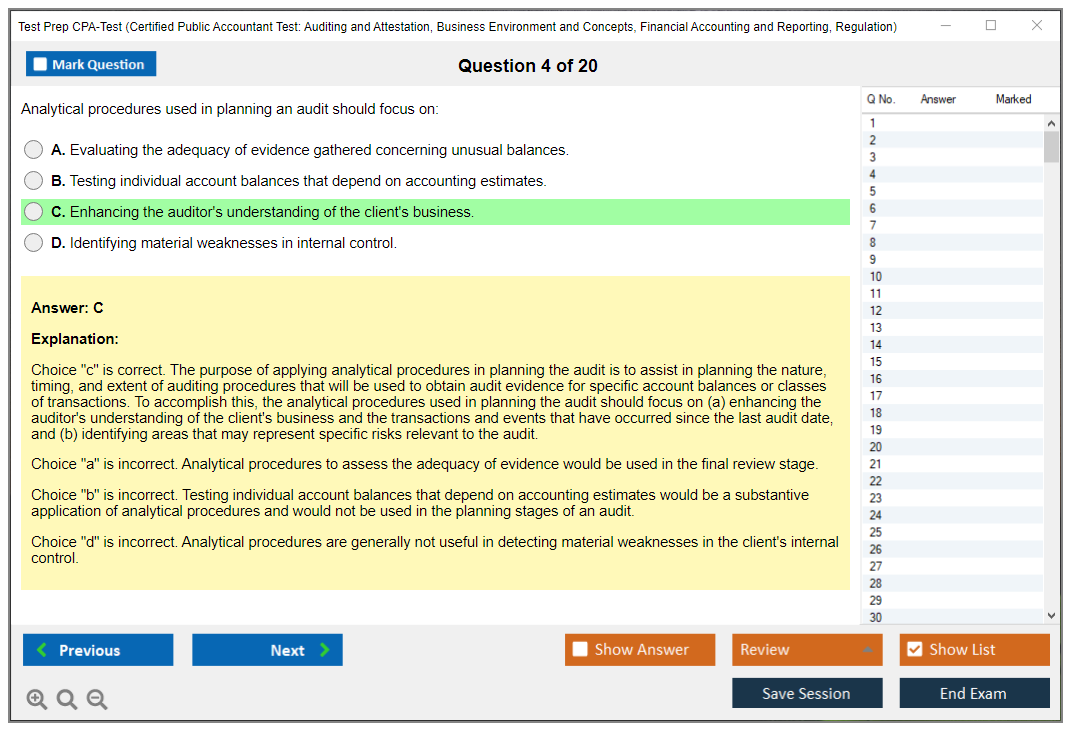

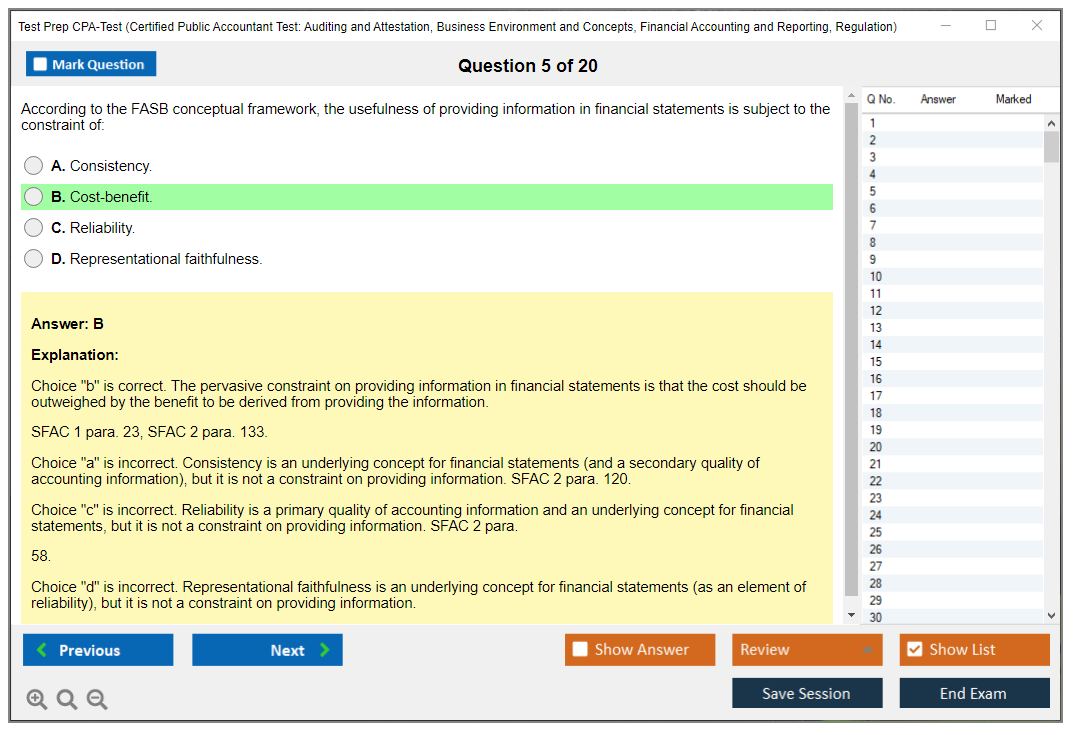

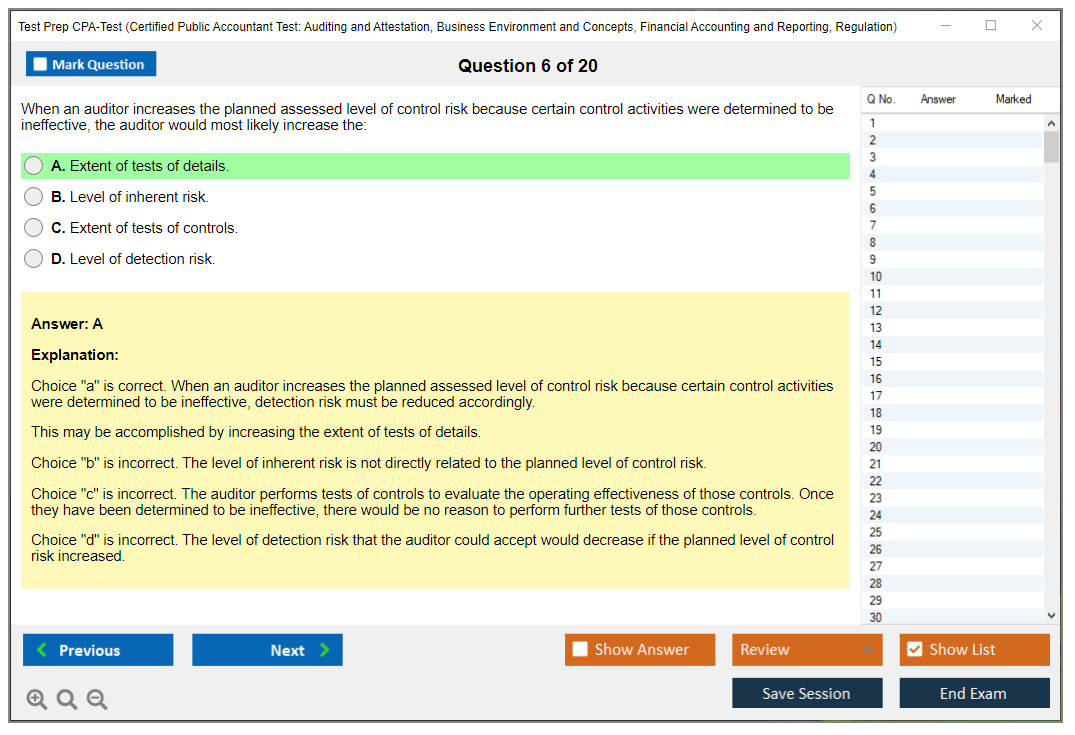

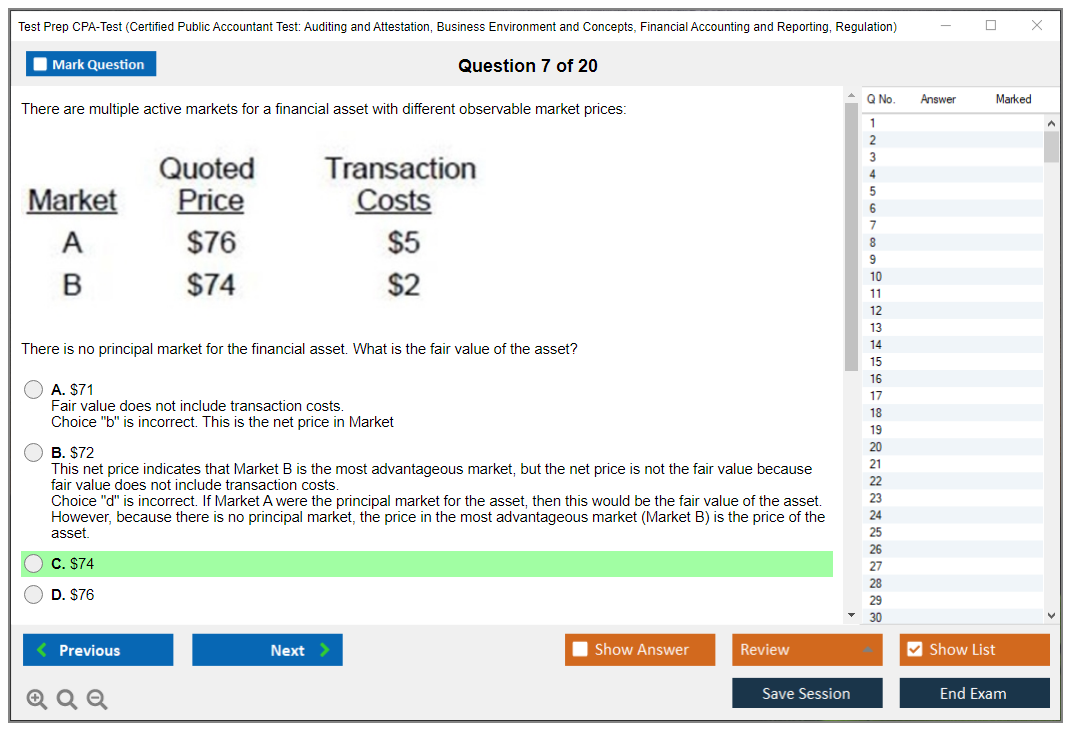

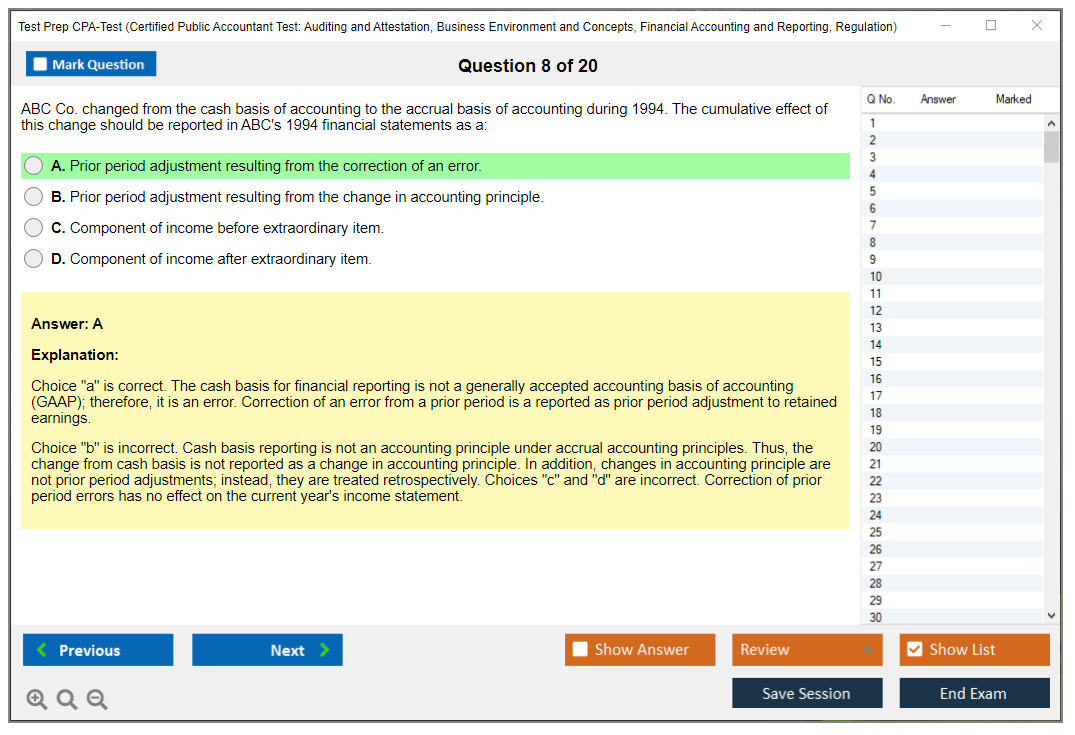

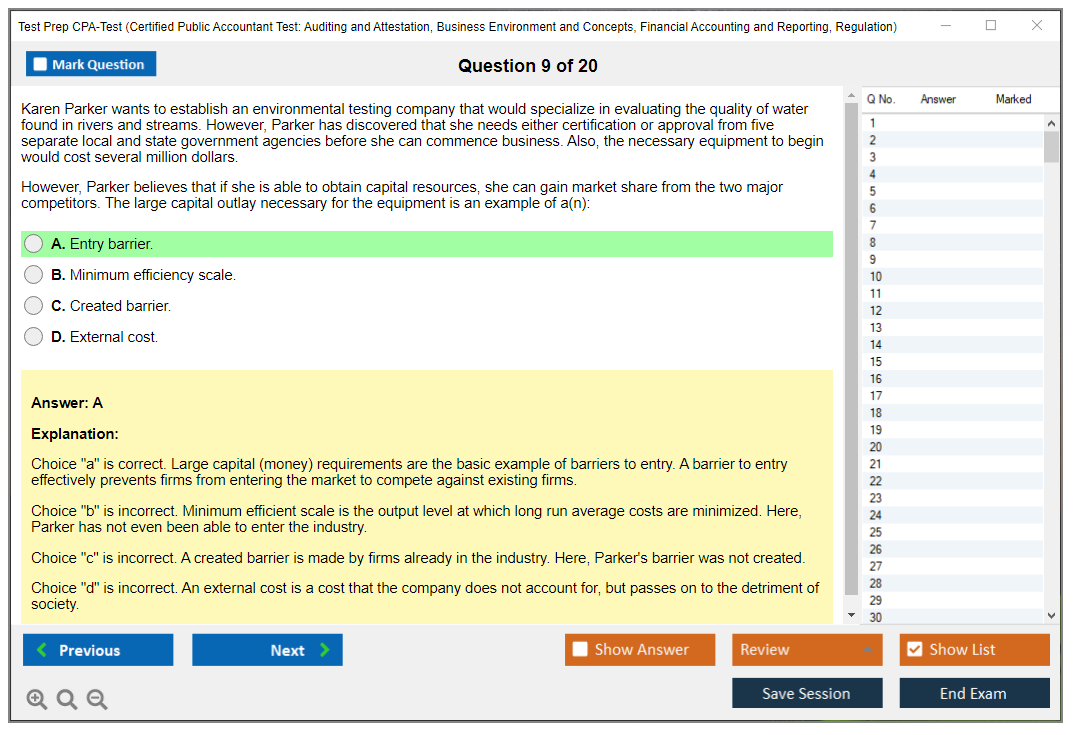

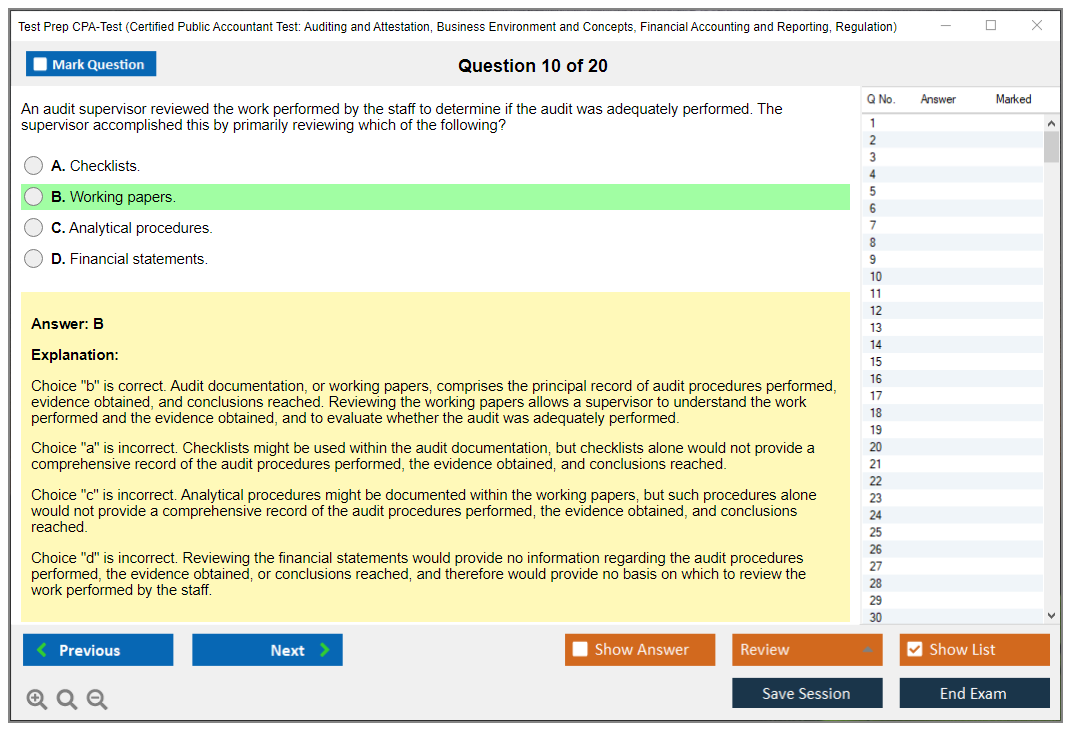

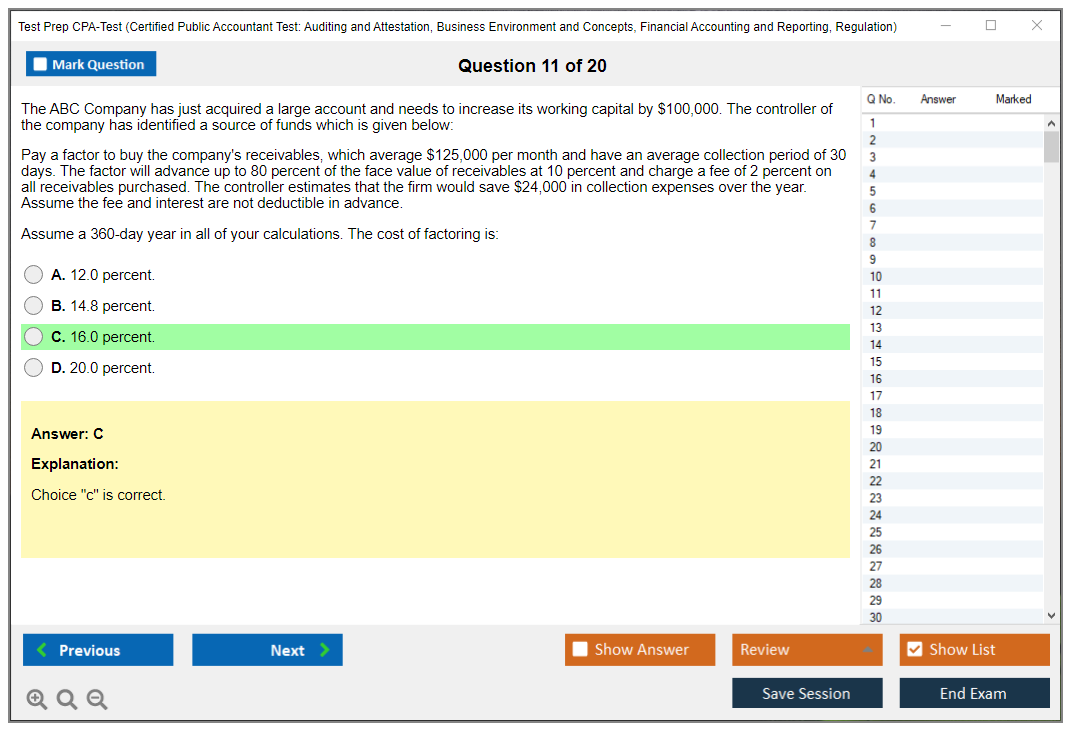

The CPA Exam covers a wide range of topics including: Auditing and Attestation (AUD): Ethics, professional responsibilities, auditing procedures, and standards. Business Environment and Concepts (BEC): Corporate governance, economic concepts, financial management, information technology, and operations management. Financial Accounting and Reporting (FAR): Financial accounting concepts, standards for various entities, and financial statement preparation. Regulation (REG): Federal taxation, business law, ethics, and professional responsibilities.

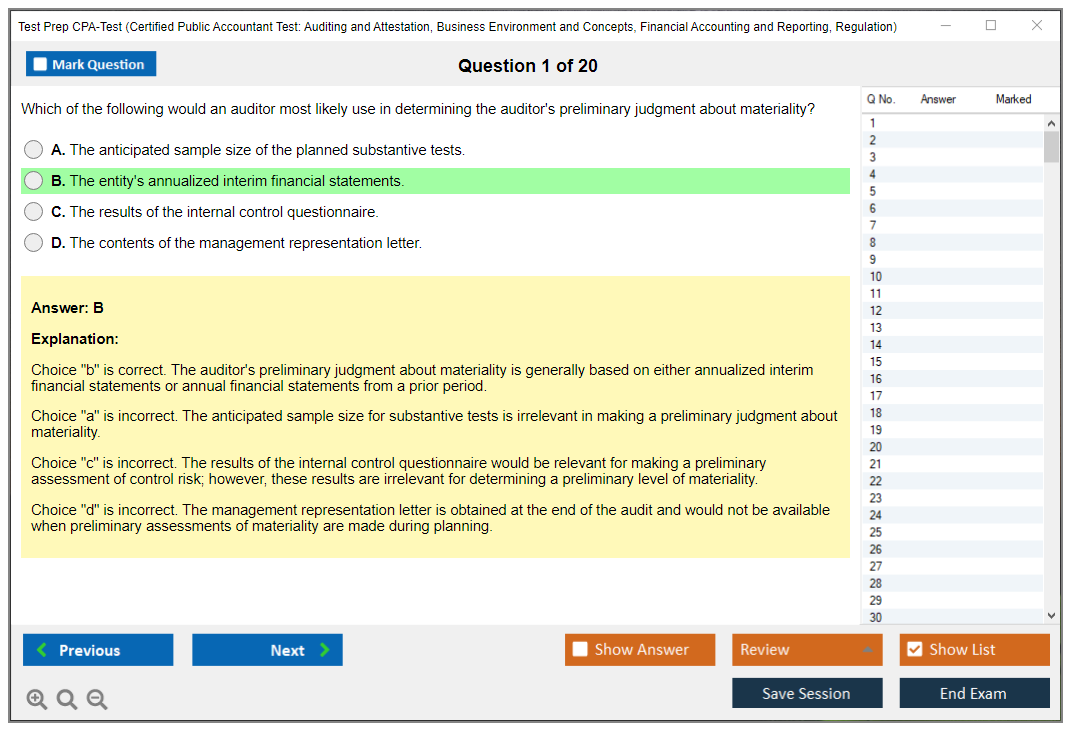

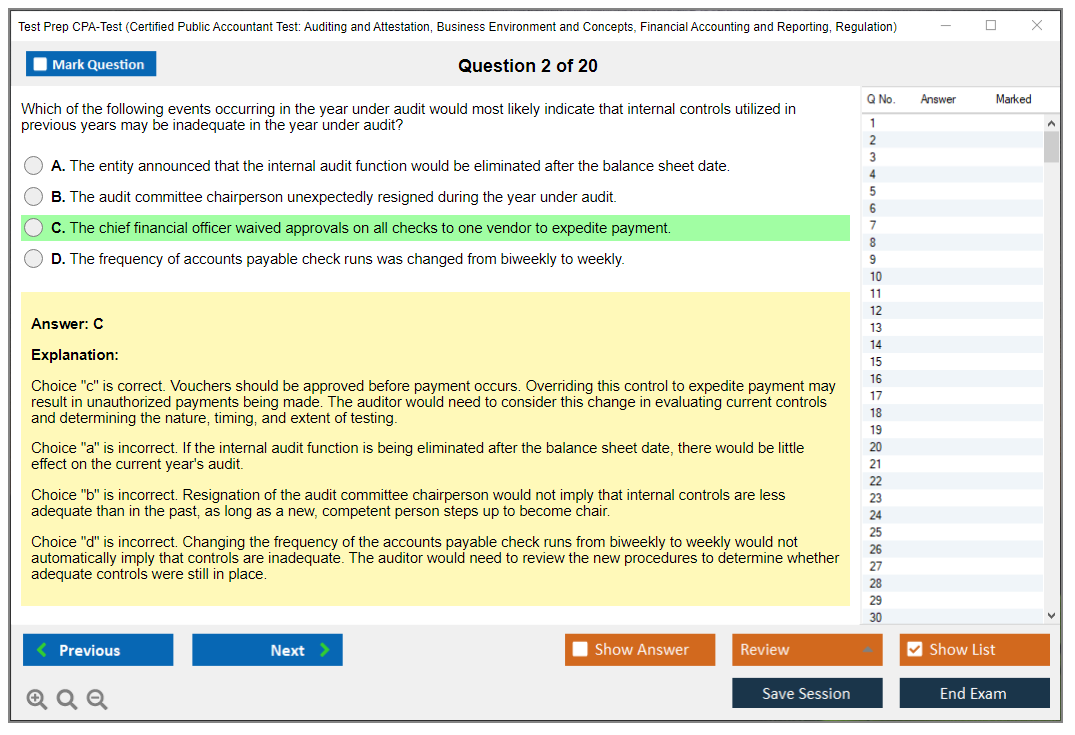

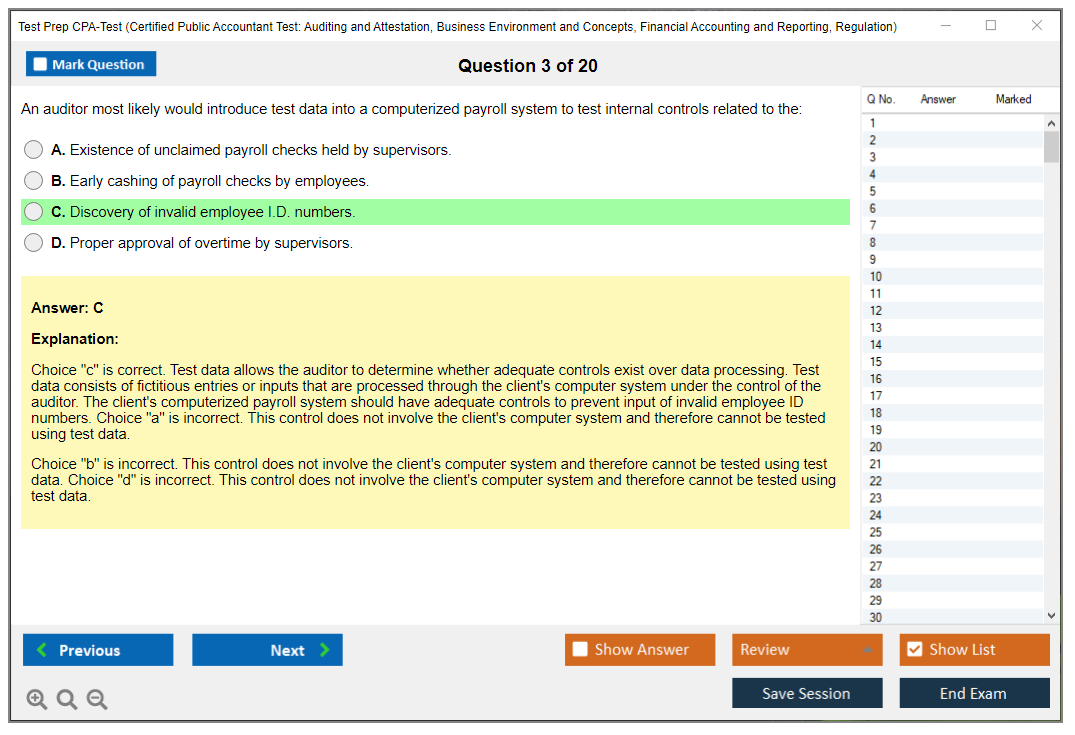

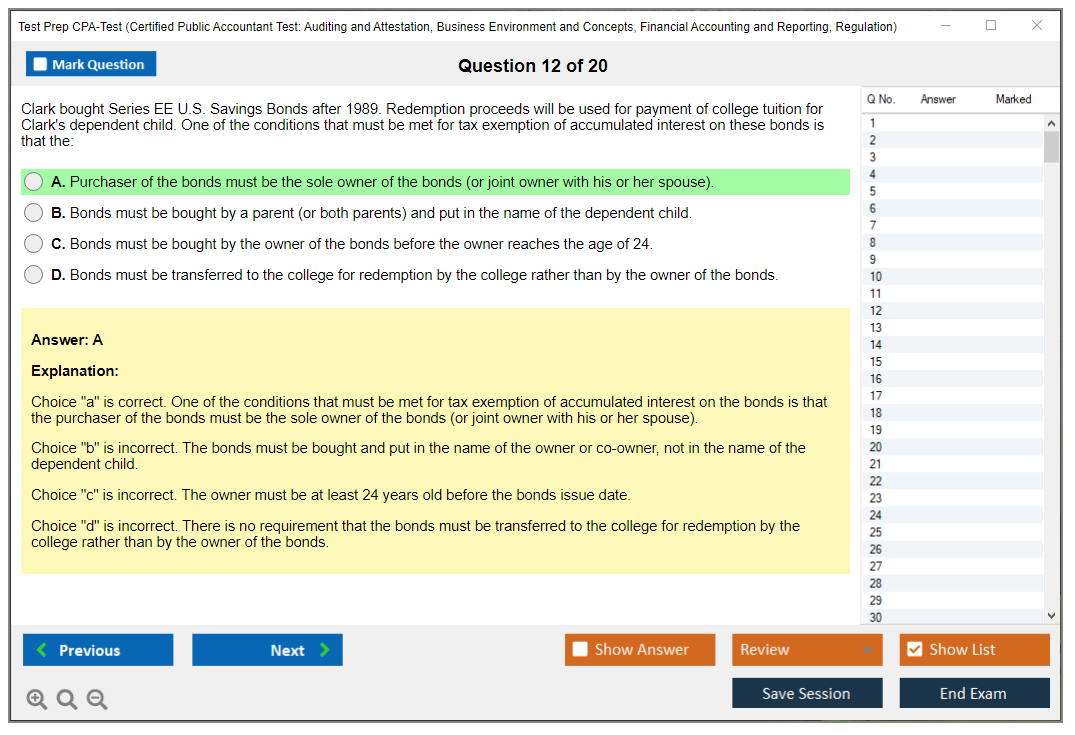

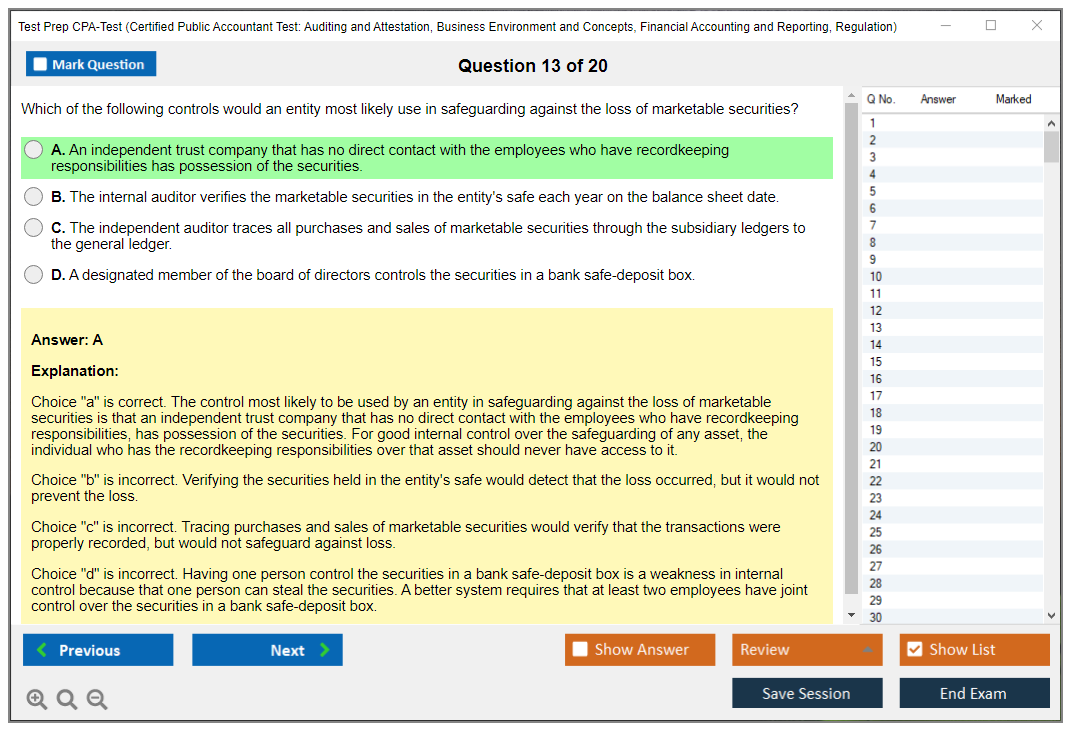

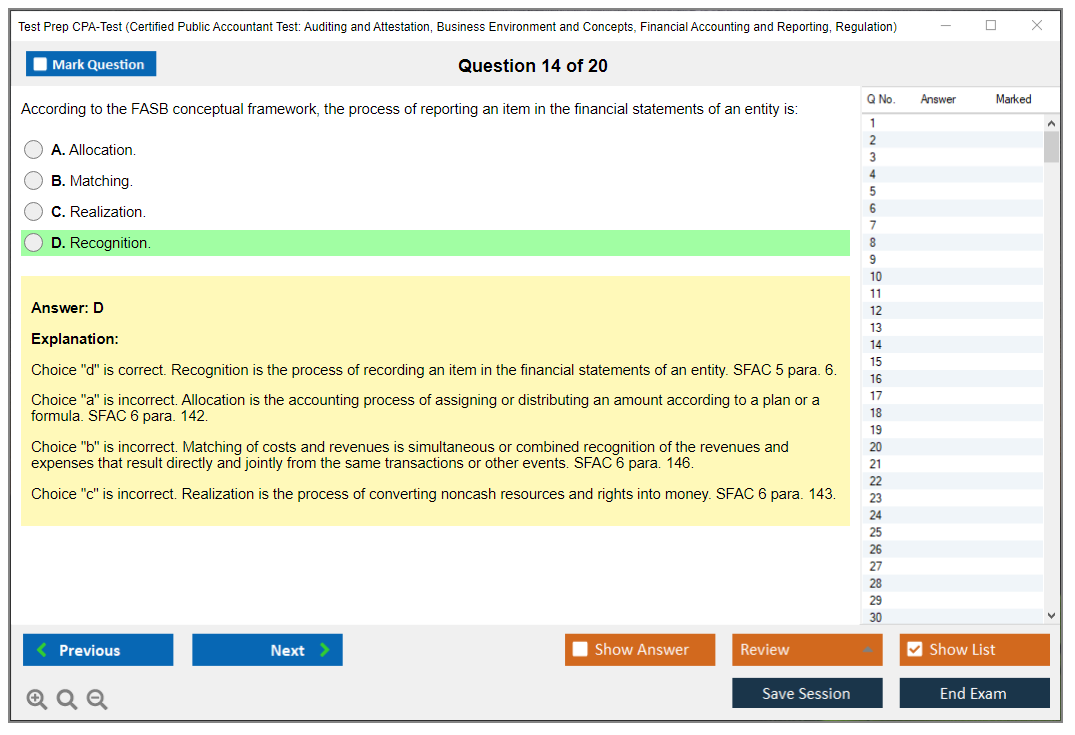

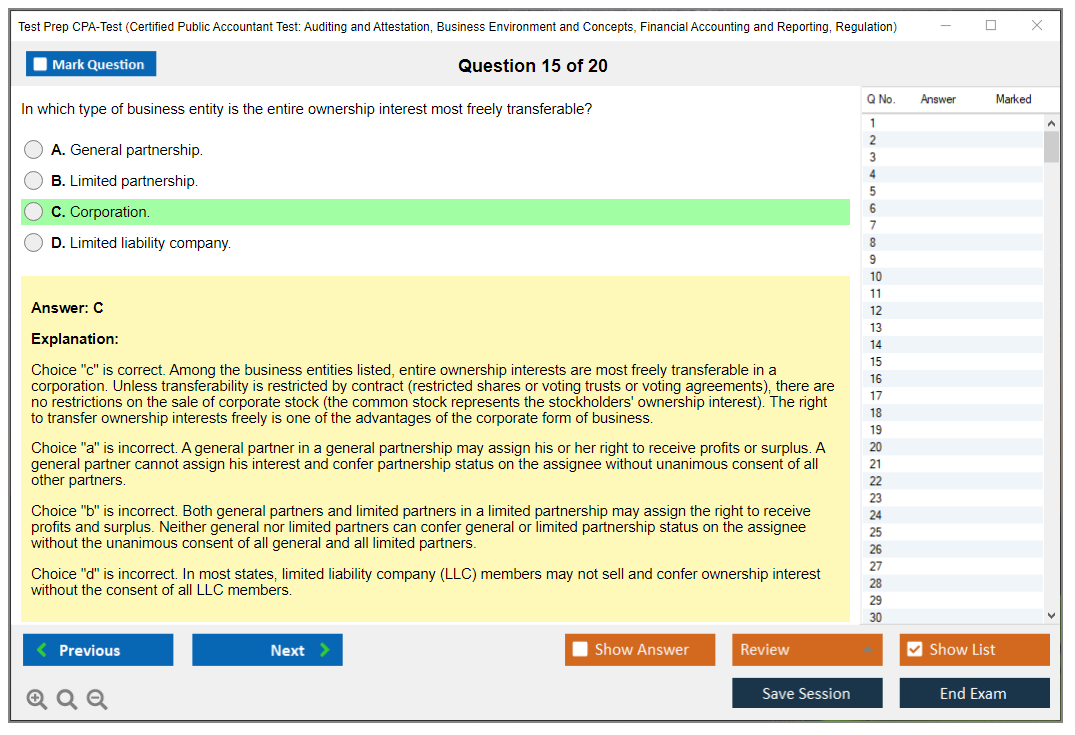

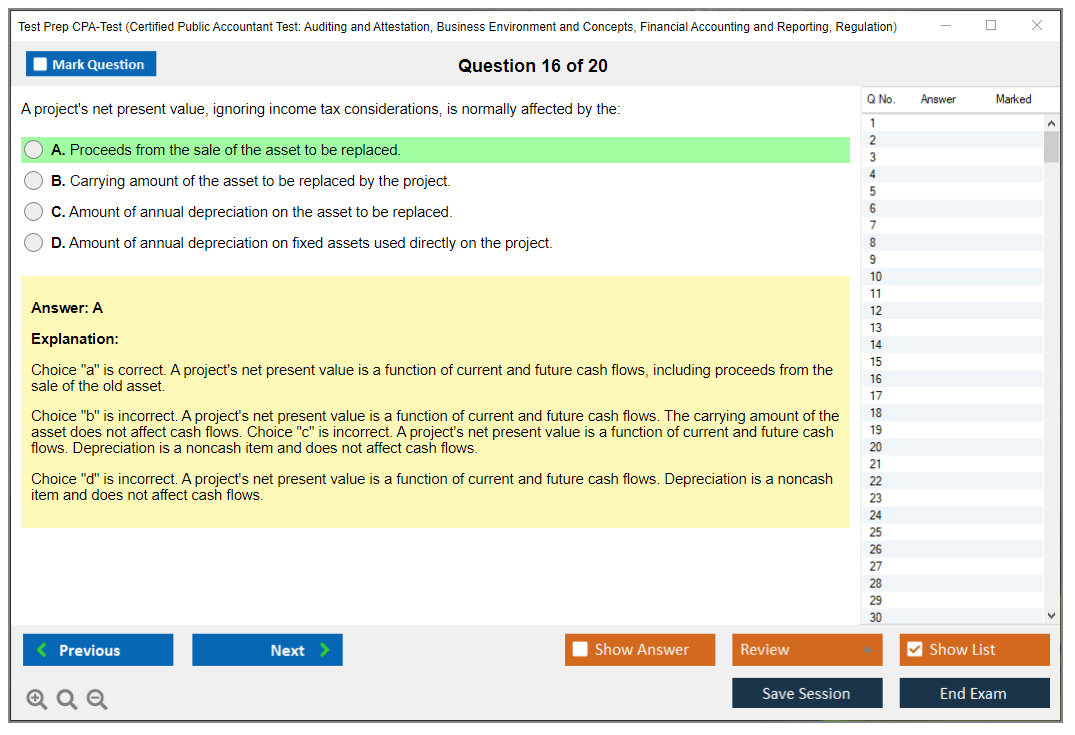

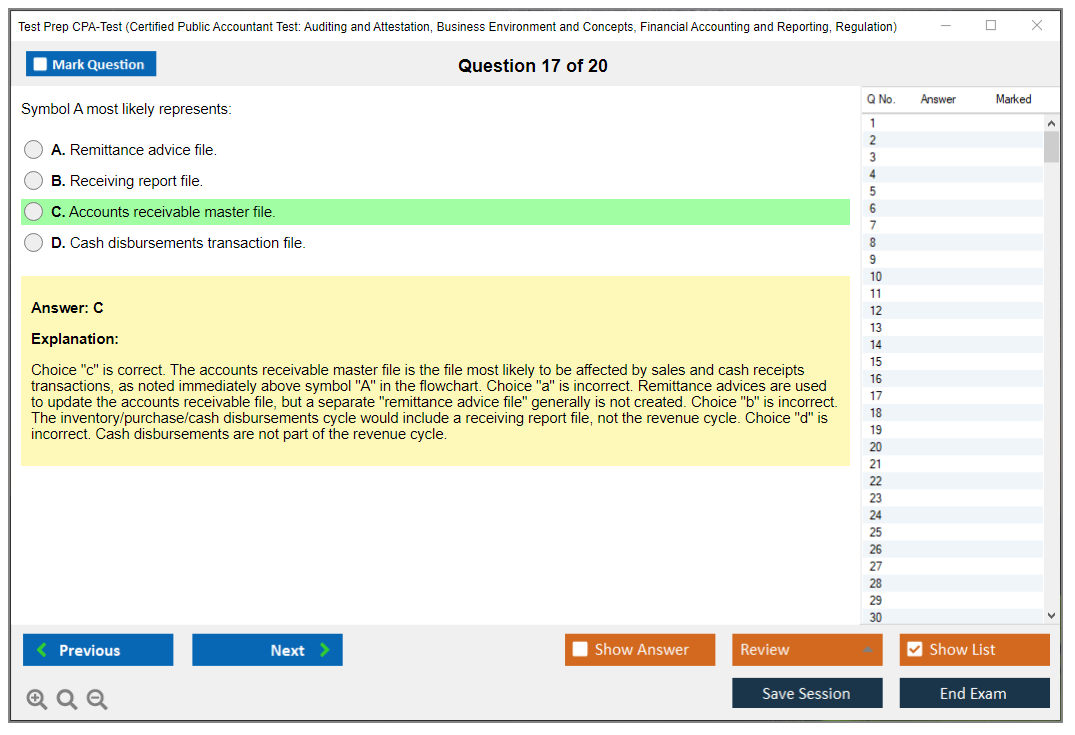

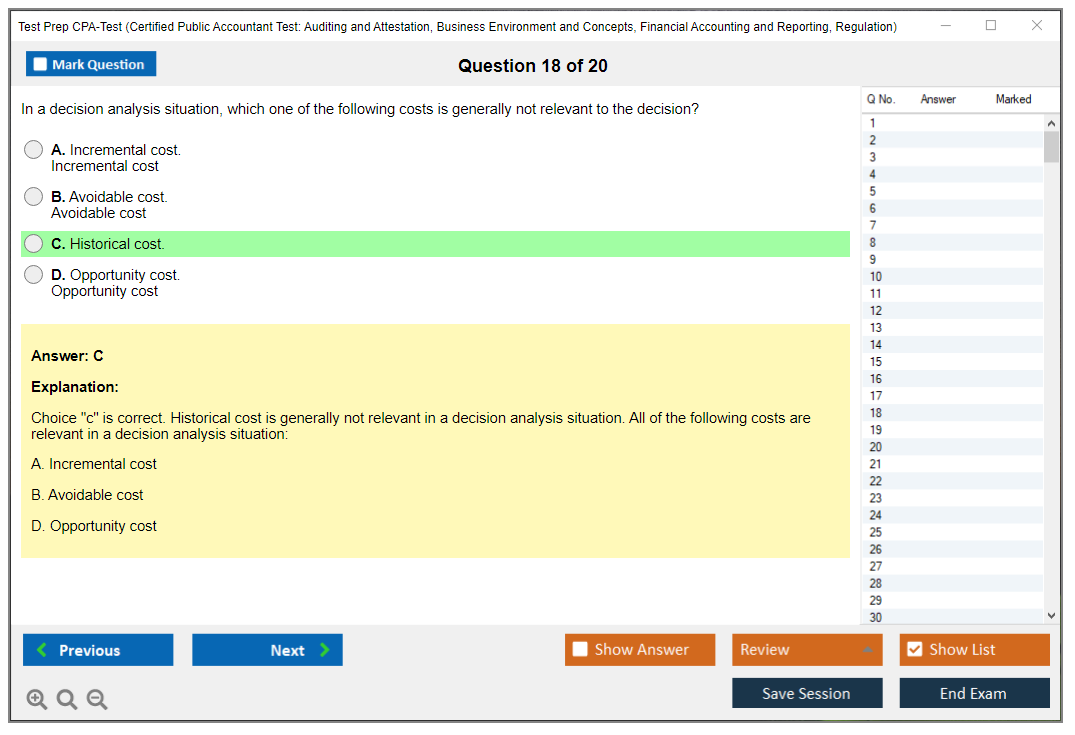

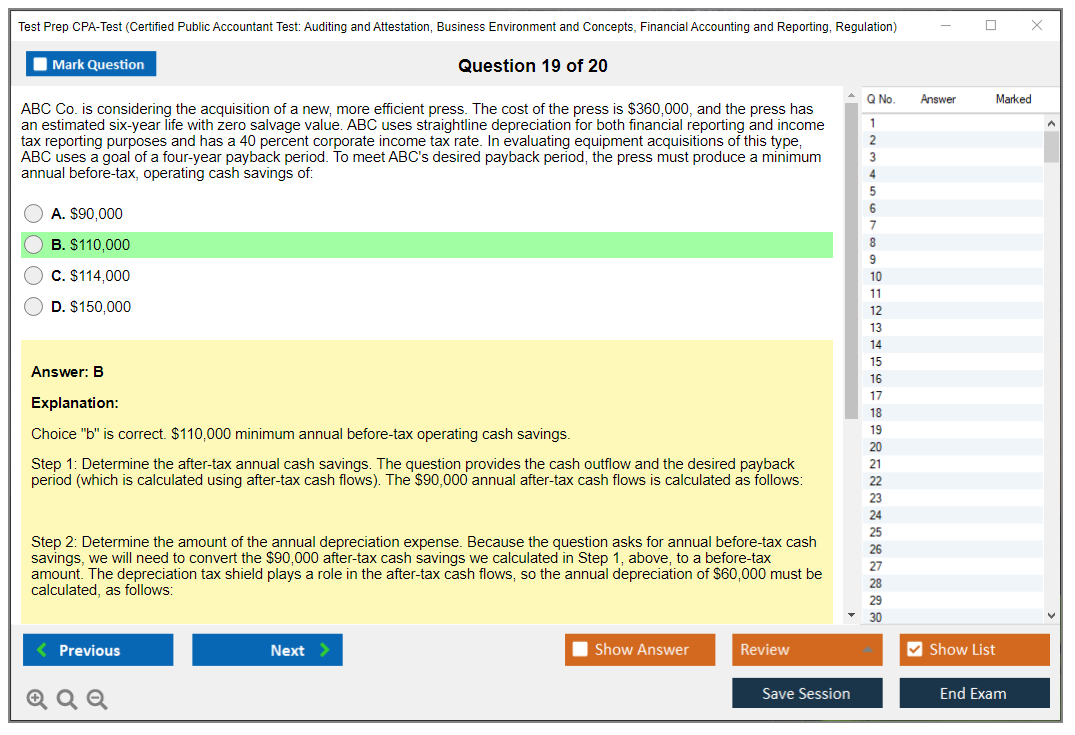

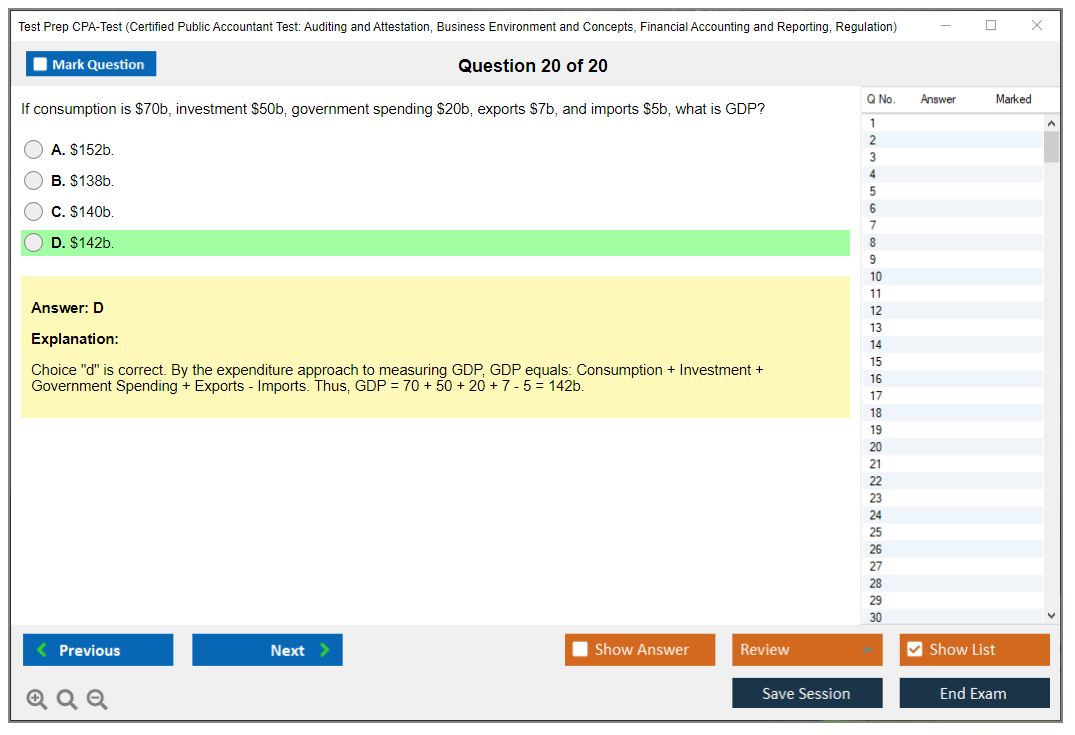

What are the Sample Questions of Test Prep CPA-Test Exam?

Sample questions for the CPA Exam can be found on the AICPA website and through various CPA review courses. These questions help candidates familiarize themselves with the format and types of questions they will encounter on the exam.